Client retention is a key driver of long-term success for financial advisors. While acquiring new clients is important, maintaining strong relationships with existing ones fosters trust, stability, and business growth. With Wealthbox’s CRM features—like activity streams, reporting, tagging, workflows, and customizable dashboards—advisors gain the visibility and tools they need to proactively engage clients, identify risks, and enhance service.

Here are five ways financial advisors can use Wealthbox to increase client retention:

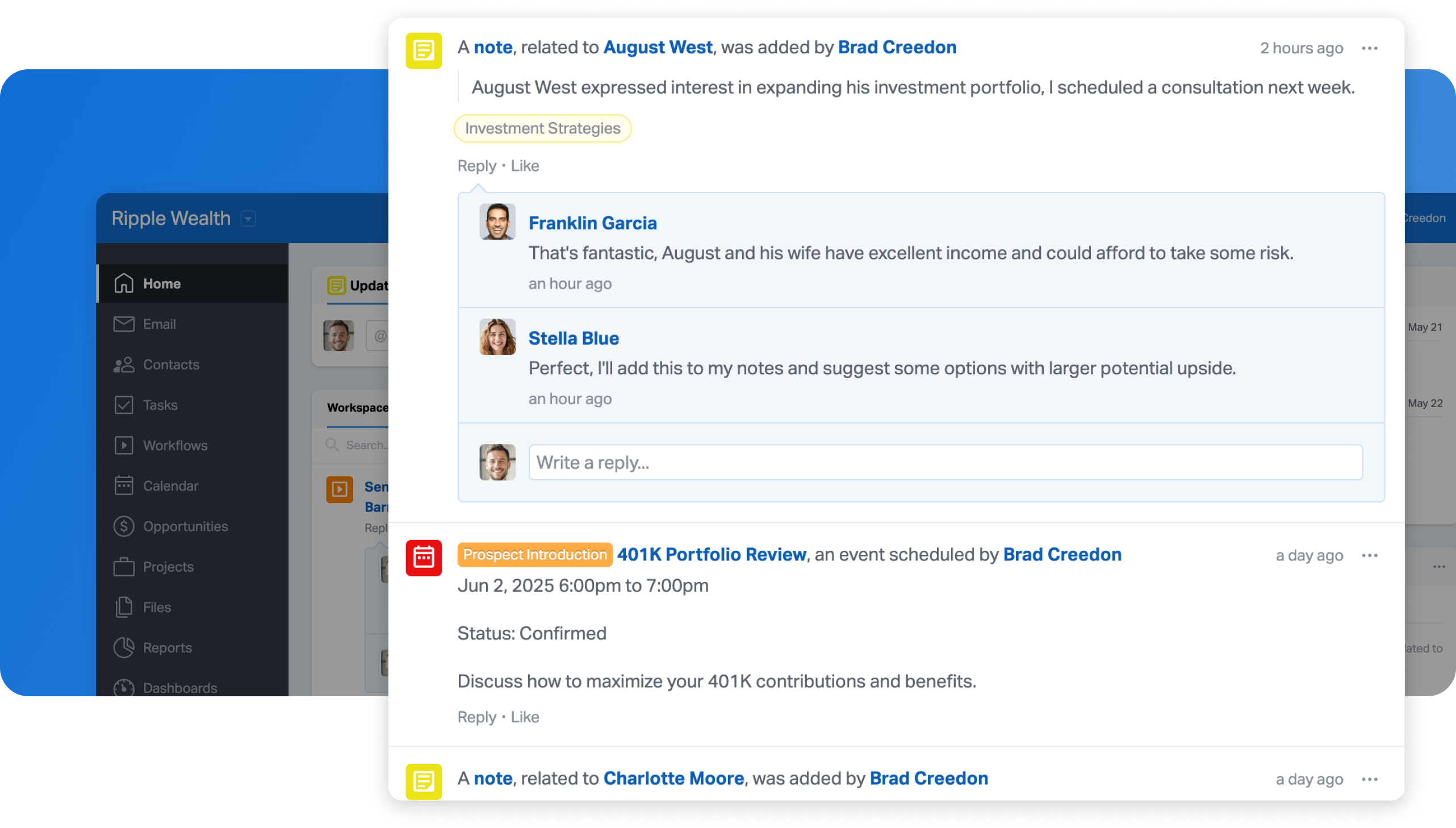

Track and Strengthen Client Engagement

Wealthbox’s activity streams and individual contact records provide firms with a real-time view of client interactions, including calls, meetings, emails, and notes. This level of visibility helps advisors identify engagement gaps and follow up promptly. If a check-in is missed, advisors can use this context to reconnect through timely, personalized outreach and strengthen client trust.

Identify At-Risk Clients

With filters and visual summaries, firms can proactively identify clients who may be disengaging. This insight enables timely, strategic check-ins or reviews to re-engage clients and reinforce the advisor’s value before relationships begin to drift.

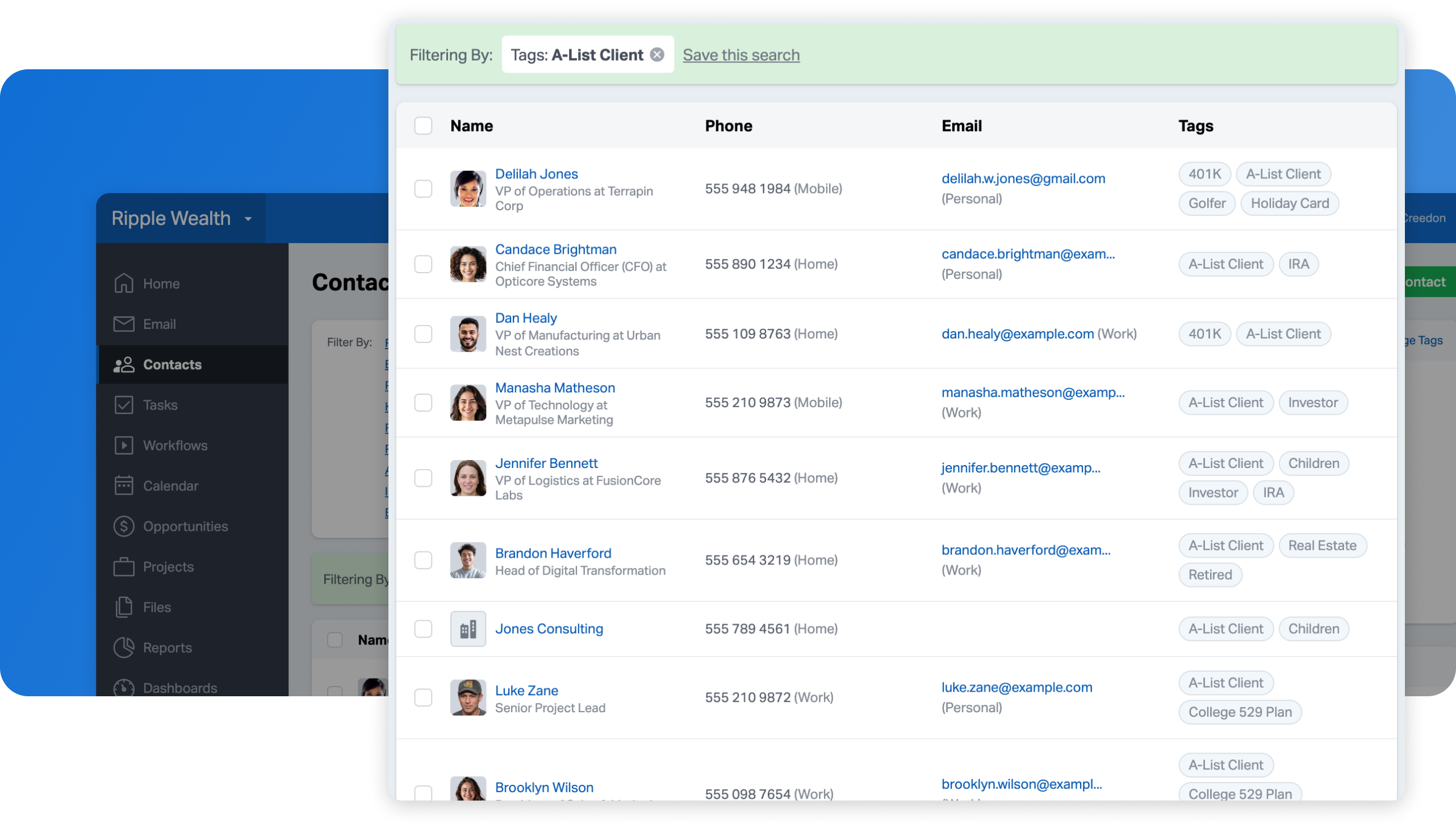

Personalize Client Interactions

Advisors can use Wealthbox tagging to group clients by interests, service tiers, or engagement history. By applying filters and segmenting contacts based on these tags and other criteria, firms can deliver more personalized outreach, such as milestone reminders, relevant updates, or curated content. These tailored experiences help enhance client satisfaction and build long-term loyalty.

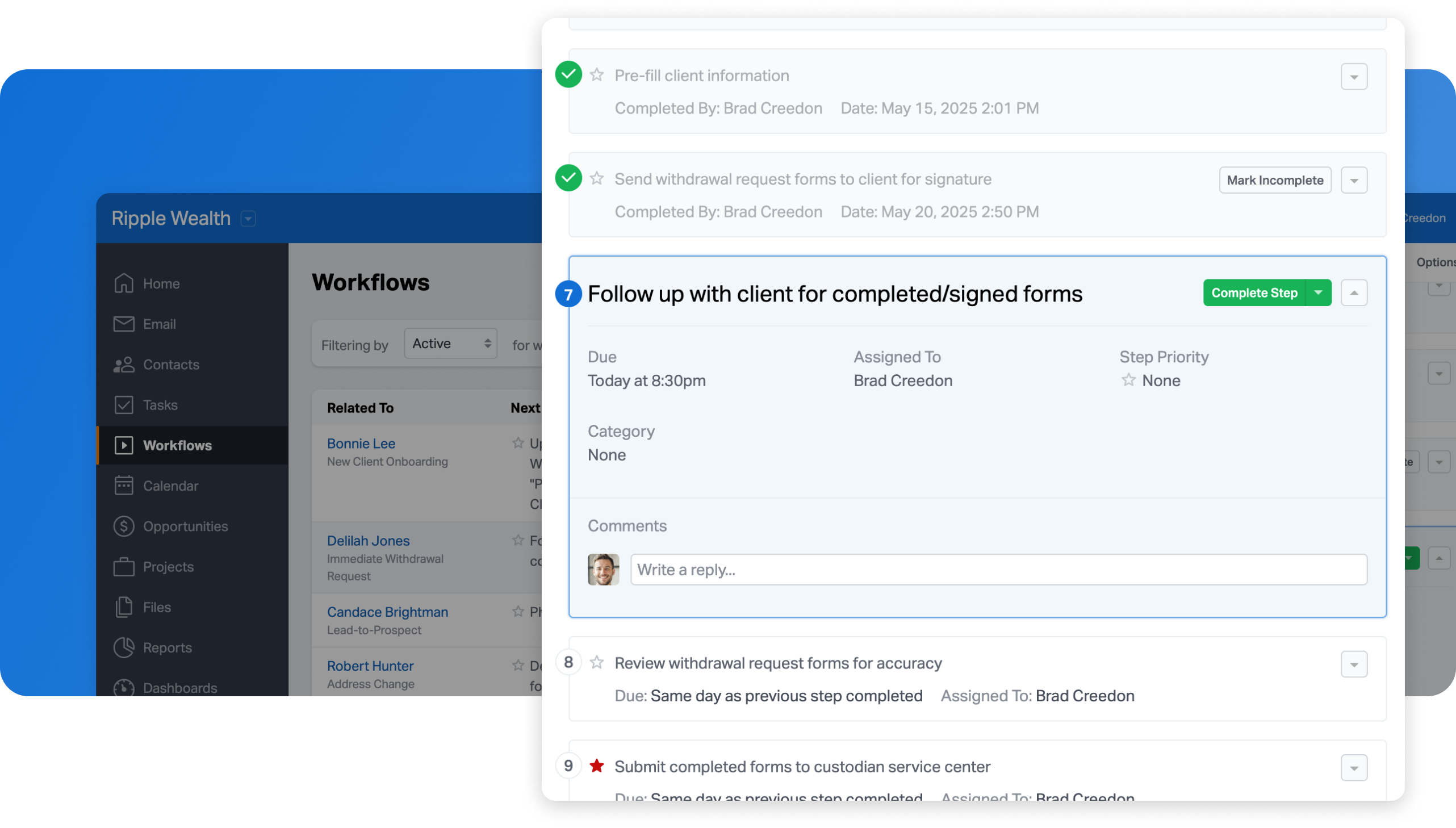

Optimize Workflows for Proactive Service

Firms can create workflows in Wealthbox to maintain accountability and ensure nothing falls through the cracks. From onboarding and review meetings to ongoing service tasks, workflows allow teams to assign responsibilities, set deadlines, and automate reminders—ensuring every client receives consistent and proactive care.

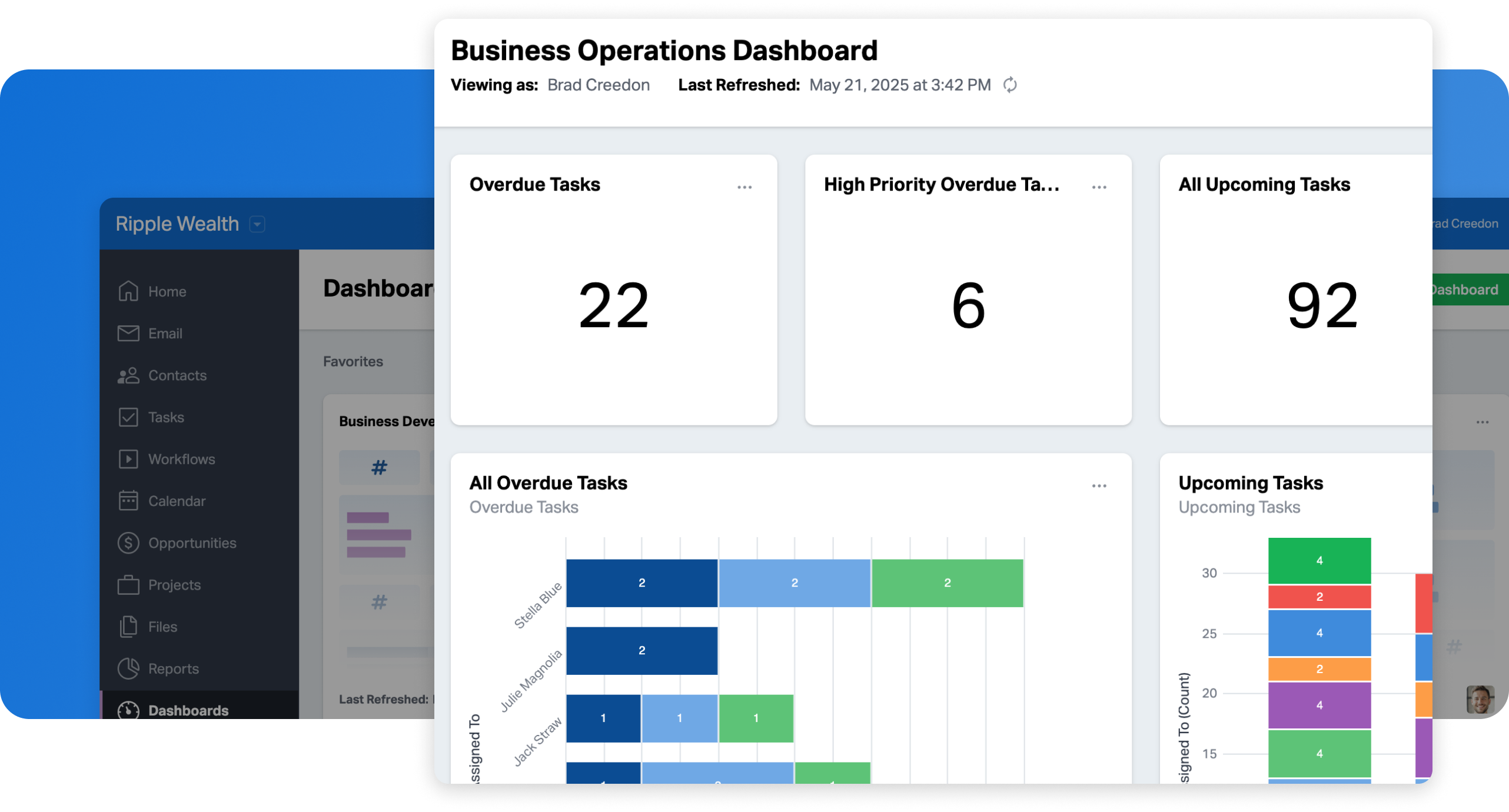

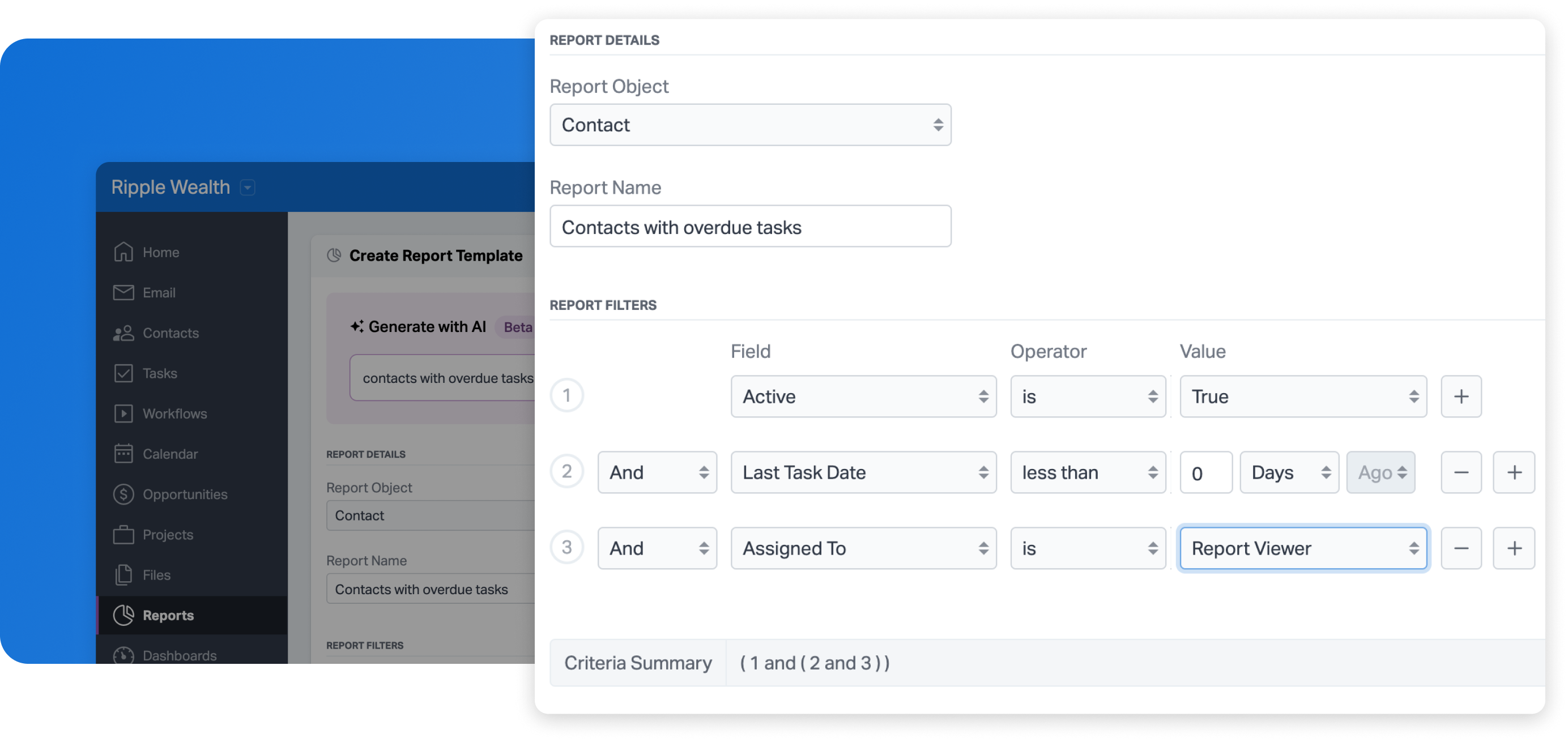

Measure and Improve Client Retention Strategies

Wealthbox’s reporting tools allow firms to track key performance indicators such as meeting frequency, task completion rates, and client outreach volume. Dynamic filters enable the creation of team- or user-specific views. By regularly reviewing these insights, firms can identify trends, enhance service delivery, and refine their client retention strategies.

Strengthen Client Relationships with Wealthbox

By using the CRM tools within Wealthbox, advisors can take a data-informed, action-oriented approach to client retention. With deeper engagement tracking, personalized service, and optimized internal processes, firms are better equipped to exceed client expectations and foster lasting relationships.