Wealthbox is excited to announce an integration with Fispoke, a technology platform designed to help financial advisors strengthen client relationships and deliver a more comprehensive wealth experience. Fispoke enables advisors to offer clients a suite of sponsored private banking products—including FDIC-insured high-yield savings accounts, residential mortgages, advisor-branded credit cards, securities, and insurance-backed lines of credit, commercial loans, and advisor financing. With the Fispoke integration, advisors can pre-fill client deposit and lending applications directly from their Wealthbox Contact data, streamlining account setup and reducing manual entry errors.

Robert Clare, CEO & Founder, Fispoke

“Fispoke is excited to partner with Wealthbox to provide advisors with a robust private banking platform, bridging the gap between traditional wealth management and private banking,” said Robert Clare, CEO & Founder at Fispoke. “Existing solutions are fragmented, requiring advisors to refer clients to outside institutions with no visibility, no control, and no compensation. By combining high-yield cash solutions, lending and banking products, and streamlined workflows, Fispoke empowers RIA firms to deliver a more complete and differentiated wealth experience—all within their existing client relationships.”

“This integration exemplifies how Wealthbox continues to connect advisors with innovative fintech solutions,” said Charlie Fargo, Head of Partnerships at Wealthbox. “By integrating with Fispoke, we’re helping advisors extend their value beyond portfolio management to include banking and lending services, all from within Wealthbox.”

Charlie Fargo, Head of Partnerships, Wealthbox

How it works

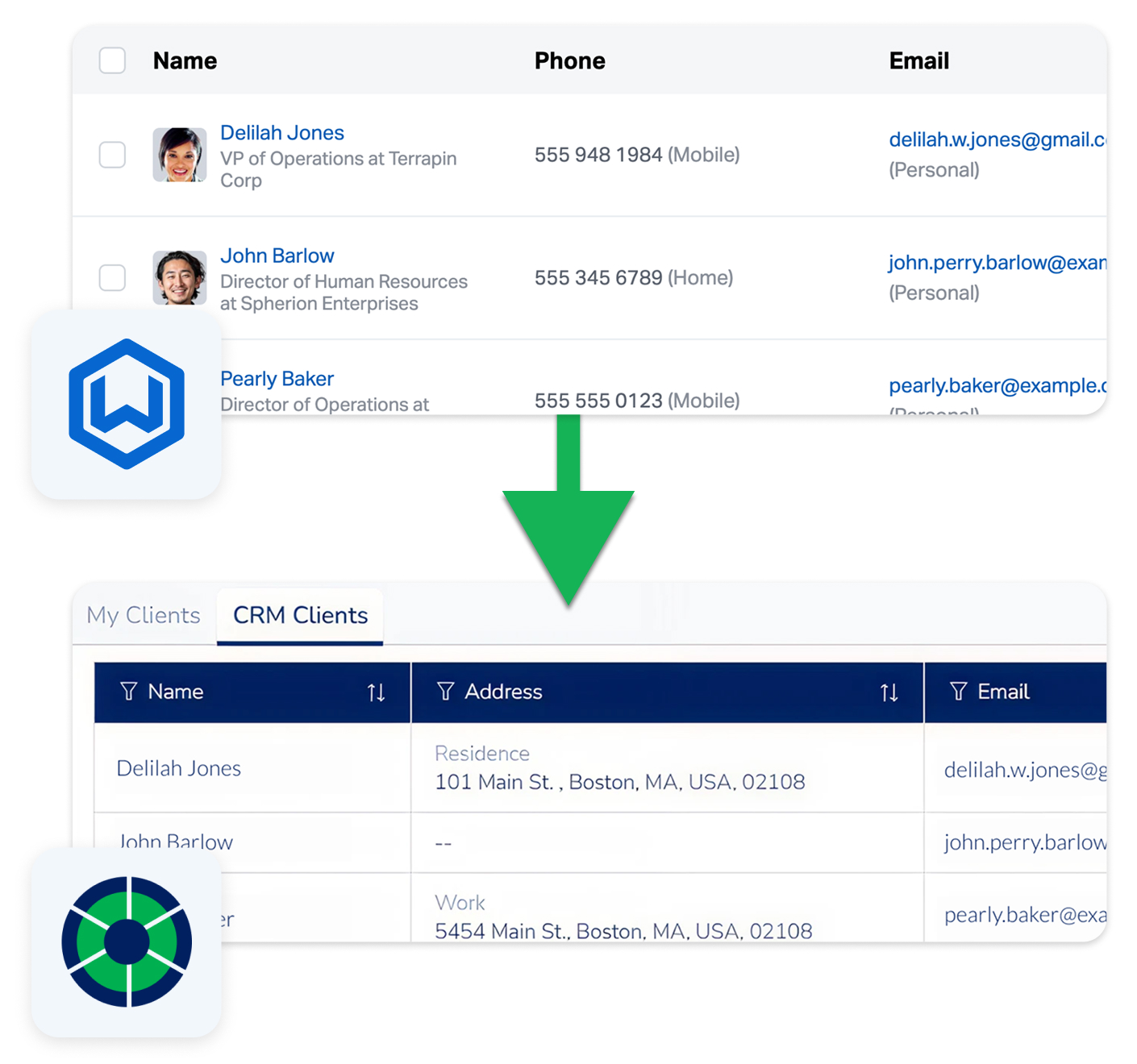

The Fispoke integration connects Wealthbox Contact data directly to Fispoke’s banking platform, allowing advisors to pre-fill client applications and deliver a faster, more accurate onboarding experience. Once connected, Wealthbox Contacts automatically sync to Fispoke in the background, ensuring that client information stays consistent and up to date across both systems.

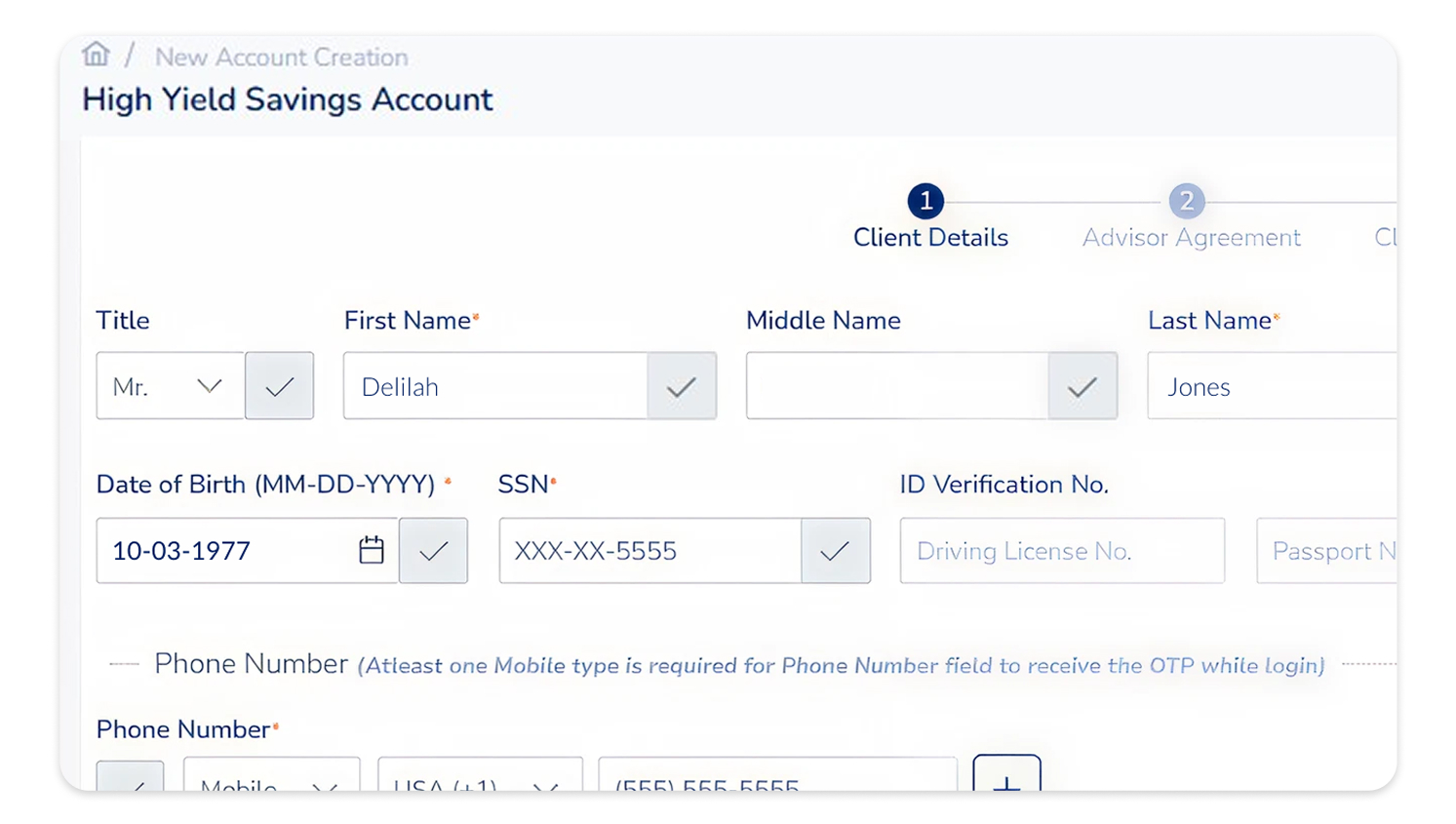

When advisors initiate a new account application in Fispoke, client details from Wealthbox are instantly populated, eliminating manual data entry and reducing errors.

This streamlined workflow improves efficiency, minimizes not-in-good-order (NIGO) applications, and allows advisors to focus on delivering a seamless, advisor-led banking experience for their clients.

Learn more

- Integration Page: Learn more on the Fispoke + Wealthbox integration page and share with coworkers.

- Help Center: Ready to use now? Enable the Fispoke integration with easy instructions.