Advisors don’t need more tools—they need the right ones. Tools that are built with the realities of a busy advisory firm in mind. Wealthbox delivers exactly that, with features that simplify the complex, automate the repetitive, and bring clarity to your day. From smarter task management to seamless integrations, here are 11 features that help turn good processes into great ones—and give you more time to focus on growing your business.

Join us for a live webinar on Wednesday, May 14th at 2:00 PM ET and learn how Wealthbox’s powerful CRM features can help you streamline operations, stay organized, and deliver exceptional client experiences.

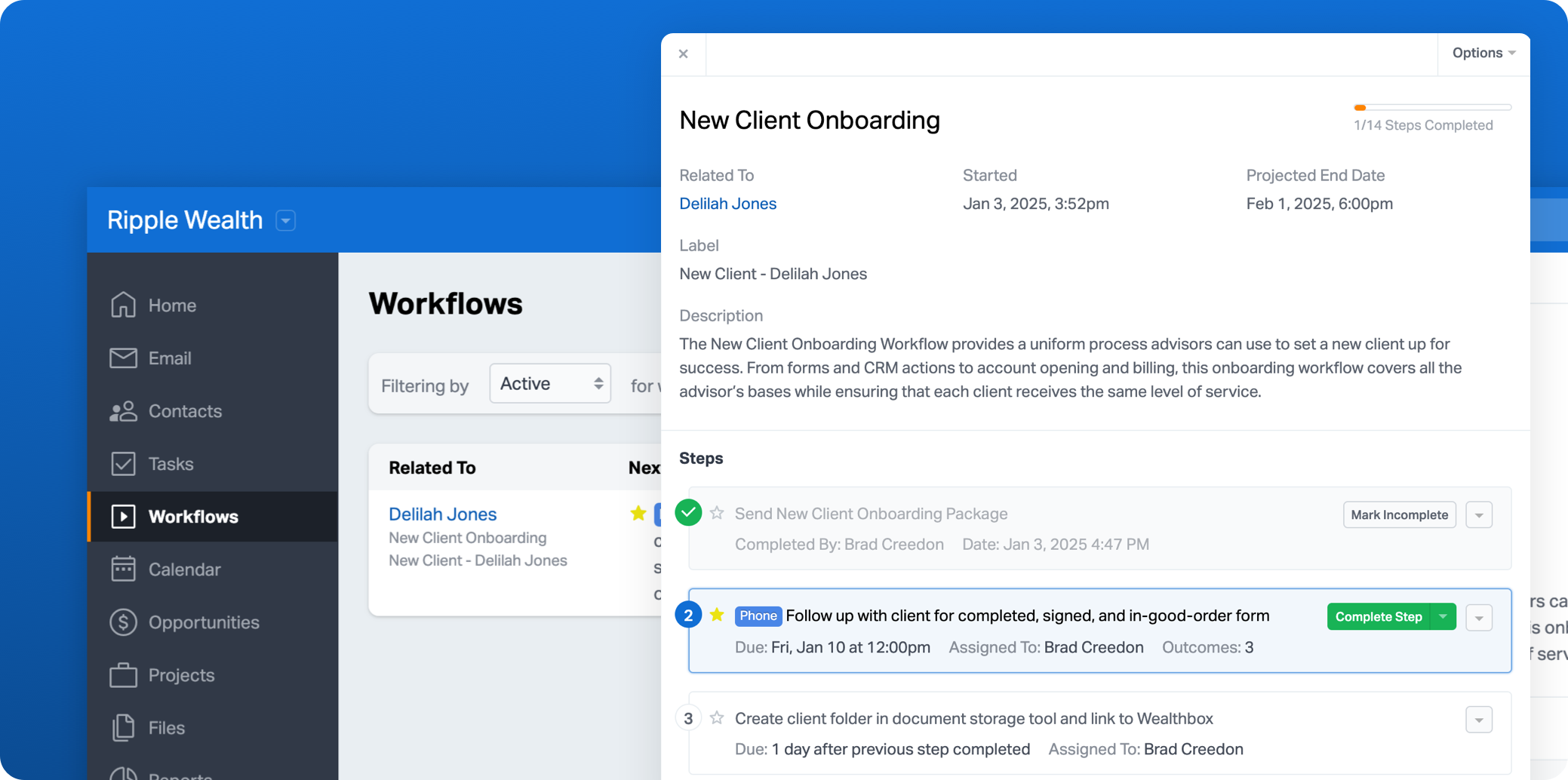

Workflows

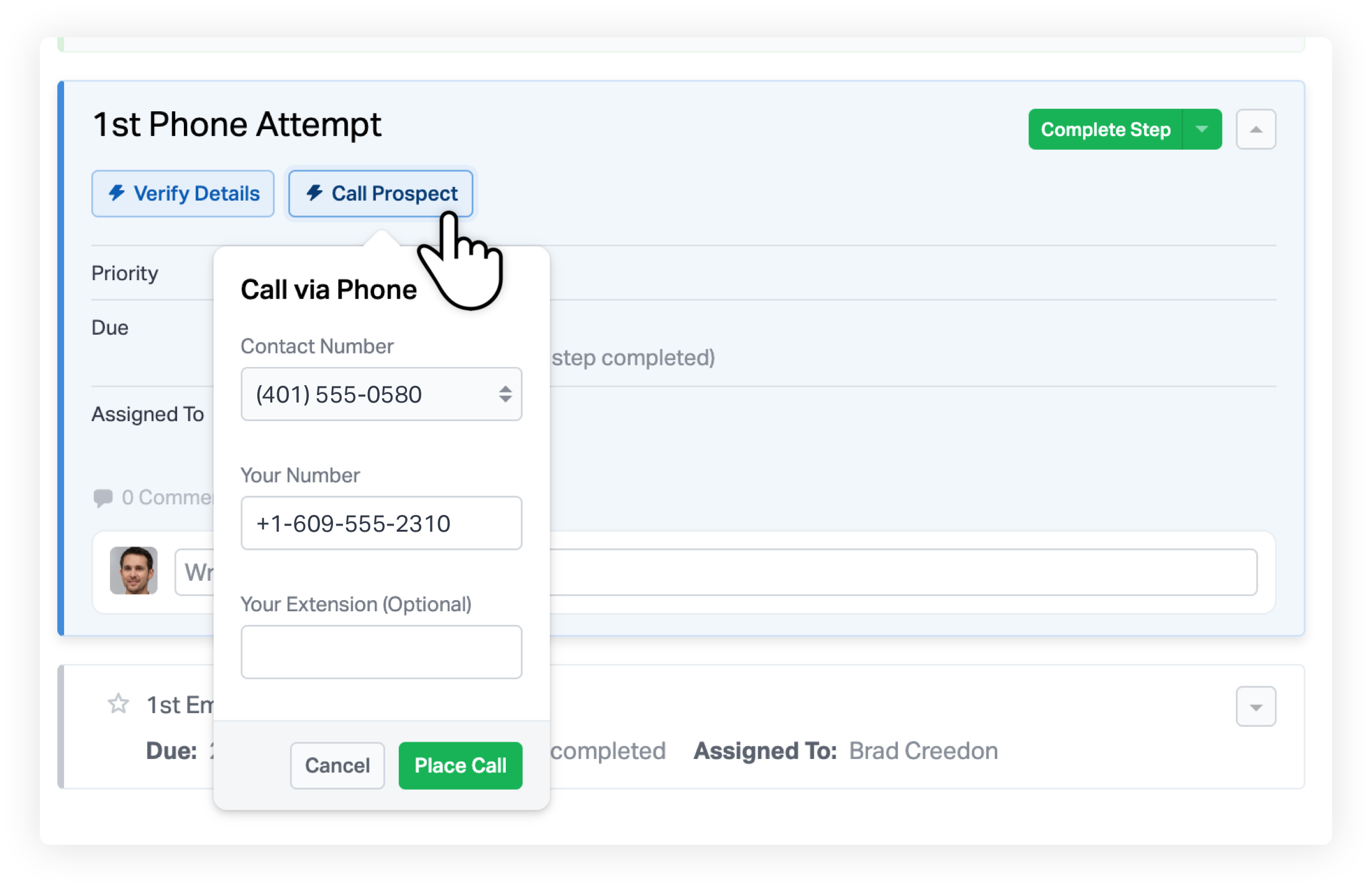

Workflows allow advisors to create structured, repeatable processes that keep teams aligned and on track. Whether onboarding a new client, conducting an annual review, or managing compliance tasks, automated workflows ensure nothing falls through the cracks. With Wealthbox, workflows are not only customizable—they’re collaborative. Assign tasks to team members, set due dates, and trigger next steps based on completed actions. You can even link workflows to contact records and opportunities, making it easy to see progress and keep everyone moving in sync.

Customizable Dashboards

Customizable Dashboards give advisors the ability to create a personalized overview of their daily activities, key metrics, and client interactions. These dashboards allow users to quickly assess important data, track progress, and view critical information with just a few clicks, helping to prioritize tasks effectively. Plus, with easy drag-and-drop widgets and real-time updates, staying on top of your business has never been more intuitive. Whether you’re managing a large book of clients or overseeing a growing team, these dashboards are the perfect tool to make smarter, data-driven decisions every day.

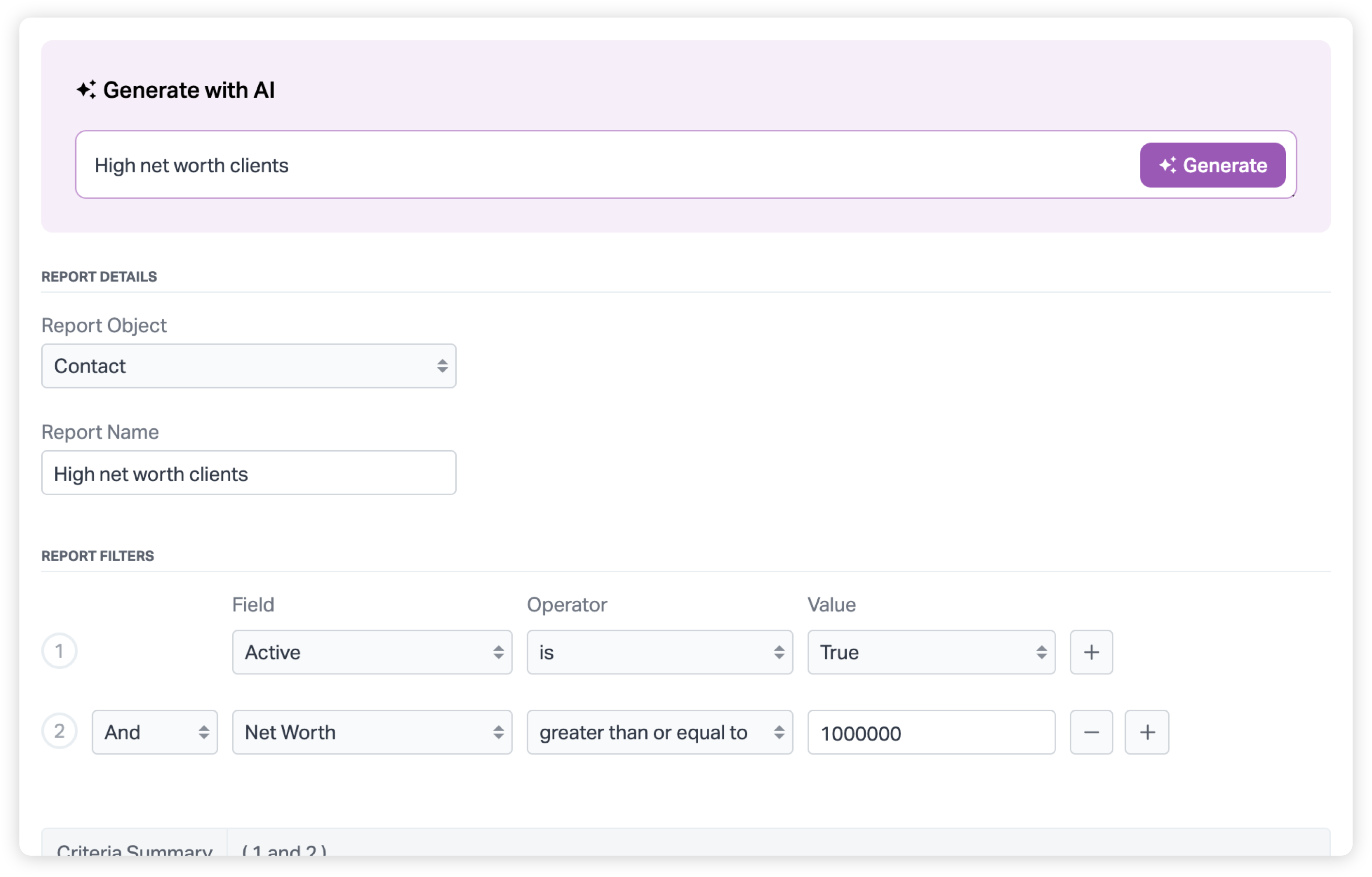

AI for Reports

AI for Reports enables advisors with AI-driven insights, making it easier to generate reports, analyze trends, and turn data into actionable decisions. With AI-powered automation, advisors can create detailed reports and dashboards in seconds—no manual data crunching required. Whether you’re analyzing client performance, tracking business metrics, or forecasting future trends, the AI-driven engine quickly identifies the most relevant data points. Advisors can then automatically generate customized reports tailored to specific client needs, reducing the time spent on administrative tasks and allowing for more meaningful, client-focused conversations.

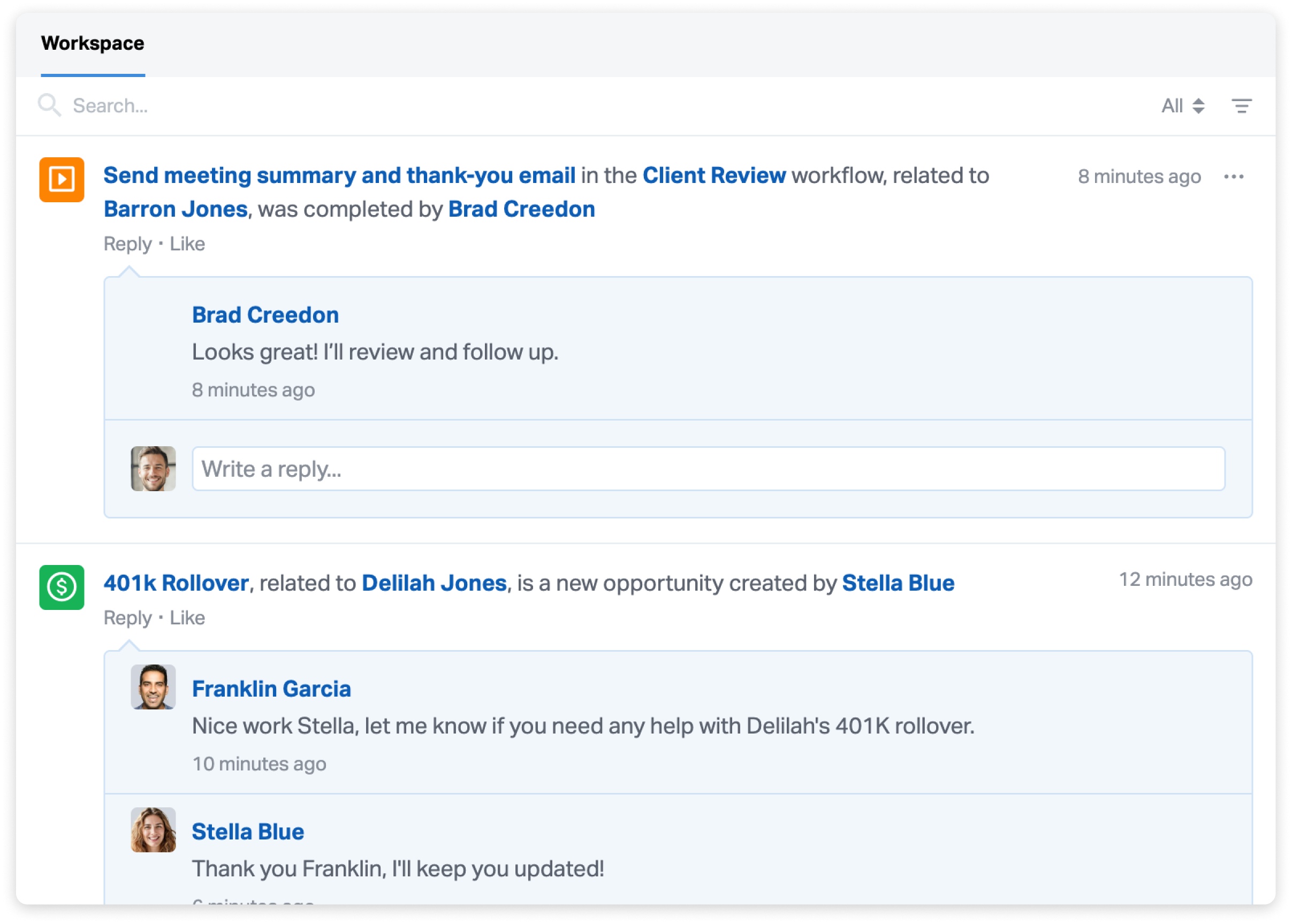

Streams for Real-Time Collaboration

The Wealthbox Activity Stream feature enables advisors and their teams to collaborate by commenting on client records, sharing updates, and notifying colleagues—all within the CRM. Instead of relying on emails or scattered notes, Streams provide a centralized, running dialogue on client interactions, ensuring everyone stays informed and aligned on key tasks and follow-ups. As tasks are completed, new meetings are scheduled, or important updates are made, the Activity Stream automatically captures these events, allowing your team to stay up-to-date without having to dig through emails or reports. It’s like having a conversation that’s always connected to the client’s history, making collaboration more efficient and insightful.

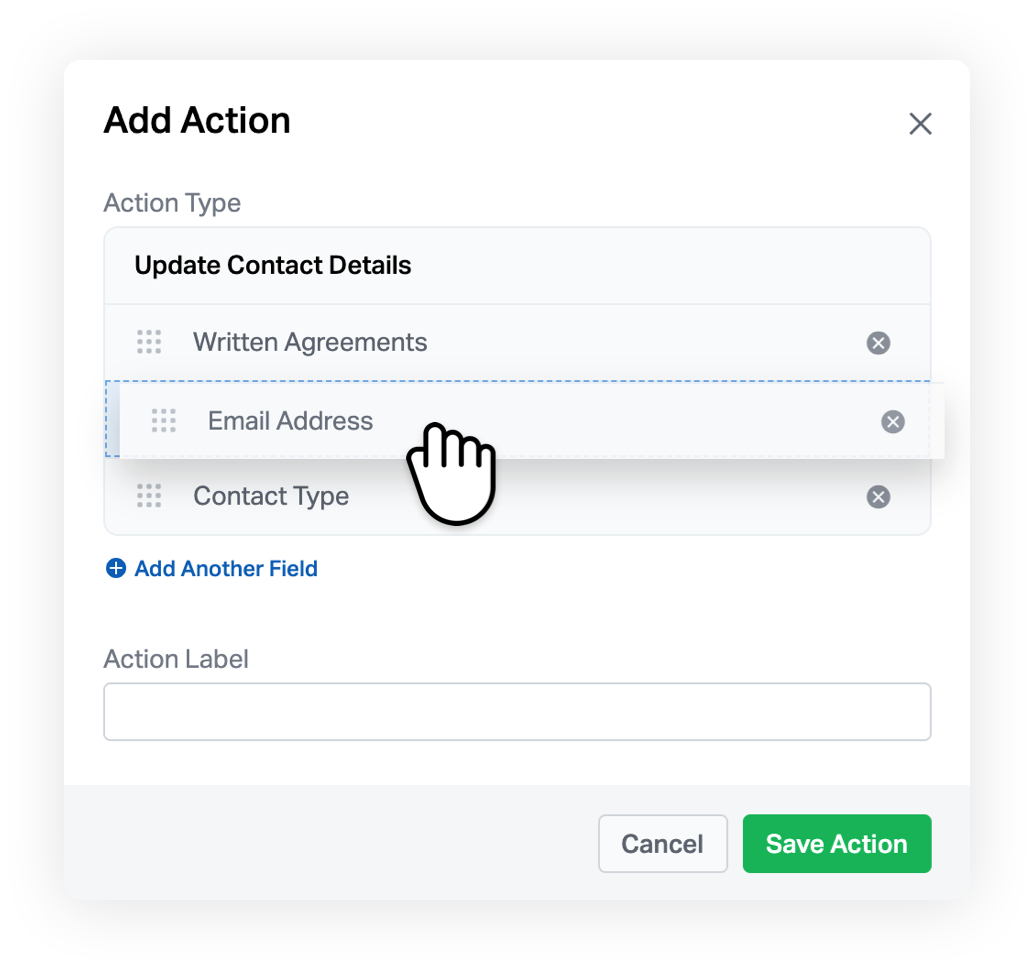

Customizable Contact Forms

Wealthbox’s Contact Form Builder enables advisors to design customized forms that suit their specific needs. Whether for client intake, feedback, or scheduling meetings, these customizable forms help streamline data collection and improve client interaction, saving time on data entry. The Contact Form Builder allows advisors to create customized forms within workflow steps, making it easier to view and update client information during key processes like onboarding or account setup.

Advisors can select specific contact fields—such as name, phone number, or Social Security number—and arrange them for quick access and clarity. These forms appear directly in the workflow, enabling advisors to verify and edit client data without navigating away from the task at hand. This reduces manual data entry, improves accuracy, and keeps workflows efficient and organized.

Customizable Homepages

With Customizable Homepages, advisors can tailor their Wealthbox experience to highlight the information that matters most. Whether prioritizing tasks, tracking pipeline progress, or monitoring client engagement, users can use their homepage to provide a clear overview of their business. Beyond just a visual layout, Customizable Homepages enable advisors to curate the exact data and widgets that fit their daily needs. With the drag-and-drop functionality, Wealthbox makes it easy to adjust your homepage, ensuring you always have the most relevant insights at your fingertips.

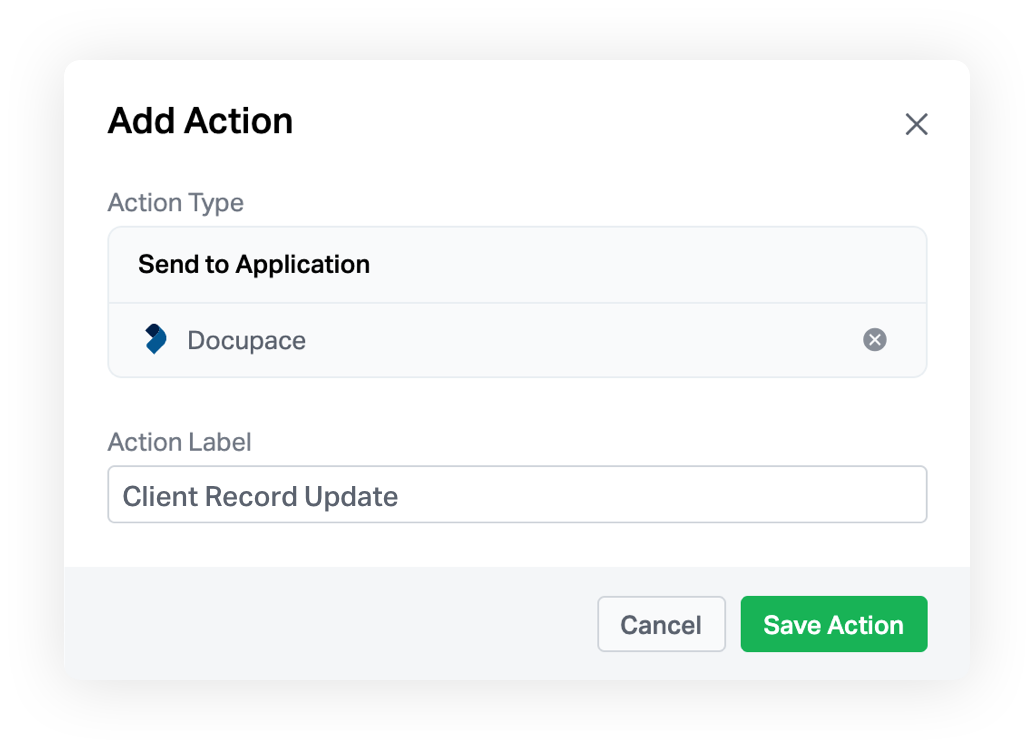

Send-To Actions

The Send-To Actions feature allows advisors to create, open, and update accounts or initiate critical documentation processes through platforms such as Schwab Advisor Center®, Fidelity Wealthscape®, Docupace, and many more. With Send-To Actions, advisors can efficiently manage client accounts, process essential documents, and update important information without ever leaving Wealthbox. Supporting a wide range of integrations, Send-To Actions makes it easier than ever to connect with the tools and platforms that drive operational efficiency.

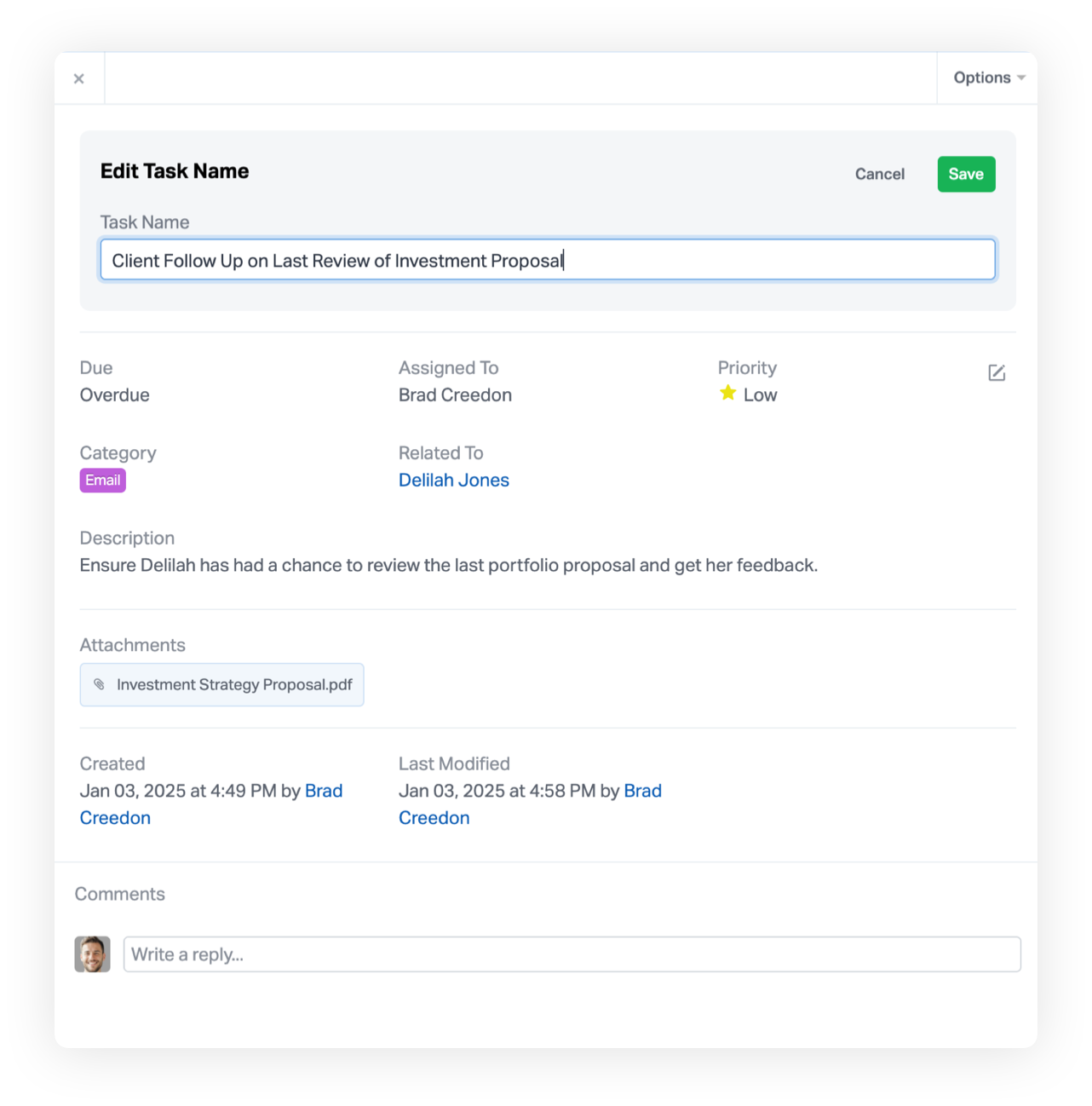

Task Management and Inline Editing

The task management feature allows advisors to assign, prioritize, and track tasks. With the ability to edit tasks inline, making quick adjustments and updates is seamless, helping advisors stay on top of their to-do lists and deliver timely service. This feature goes beyond simple task tracking by offering powerful customization options. Advisors can create tasks with specific due dates, set recurring reminders for regular activities, and categorize tasks based on priority or client urgency. Plus, with team collaboration built into the system, advisors can delegate tasks to colleagues, track their progress, and receive notifications when tasks are completed.

Client Communication Tools

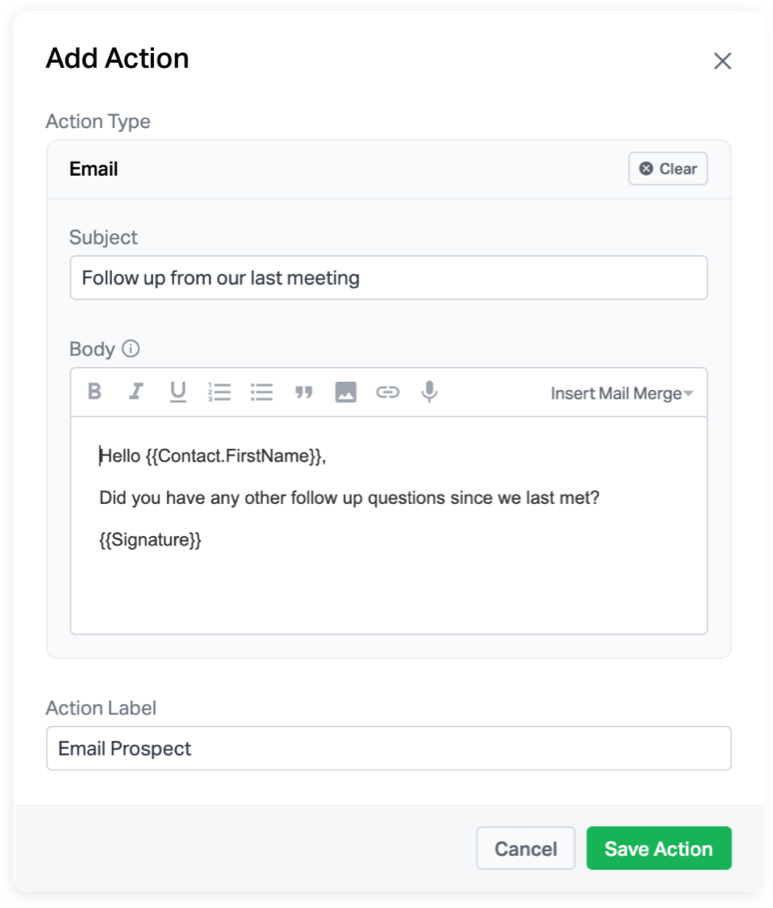

Effective communication is at the heart of every successful advisor-client relationship. Wealthbox offers integrated tools for email and task reminders, ensuring advisors can stay in constant contact with clients while maintaining a high level of personalized service. Beyond just sending messages, Wealthbox’s communication tools are designed to enhance the advisor-client experience. Advisors can seamlessly send and track emails or set automated alerts for important dates, such as client birthdays or upcoming reviews. These communications are all integrated within Wealthbox, so advisors have a complete history of interactions with each client, giving them valuable context for more informed conversations.

Broadcast Email

The Broadcast Email feature allows advisors to send personalized mass emails to clients and prospects directly from Wealthbox. Whether sending a market update, a firm newsletter, or an event invitation, this tool simplifies outreach while keeping communications professional and efficient. Advisors can easily segment their client base by various criteria—such as life stage, investment goals, or interaction history—and tailor messages accordingly. This ensures that each recipient receives relevant content, which enhances engagement and strengthens relationships.

Mobile Access

The Wealthbox mobile app puts your entire CRM experience in the palm of your hand. Whether you’re meeting with a client, attending an event, or traveling, you can quickly look up client records, update notes, schedule meetings, and even review tasks, all from your phone or tablet. Real-time syncing between the app and the desktop platform ensures that your data is always up-to-date, eliminating the risk of missing important updates or tasks.

Fuel Your Productivity with Wealthbox

By using Wealthbox’s powerful features, advisors can eliminate inefficiencies, improve collaboration, and focus more on what truly matters—serving their clients. Whether optimizing workflows, enhancing communication, or gaining deeper client insights, Wealthbox helps advisors fire up their day to easily grow their business.

Join us for a live webinar on Wednesday, May 14th at 2:00 PM ET and learn how Wealthbox’s powerful CRM features can help you streamline operations, stay organized, and deliver exceptional client experiences.