Super Apps

The term “super app” is now bandied about in consumer software markets. It’s gaining traction as a concept that describes a dominant, widely used software application that sits atop and works with complementary software products from different vendors in a given market. Super apps are the “digital front door” for a user to access a core application and gain further value from the connected functionalities to it. In business-to-consumer software, super apps can offer an integrated and contextually relevant experience among different underlying software applications.

In the business-to-business software market of wealthtech, the super app concept is strikingly in line with how CRM is on the rise to become the super app of wealthtech. While already the most popular software used by financial advisors, we think modern CRM technology – with advancing features, new add-on products, and improving integrations – is on a path to become the super app at the nexus of a financial advisor’s interactions with people, technology, and wealth. CRM is that digital front door for advisors to not only manage client relationships but also collaborate with their teams and operate their businesses in the interplay of integrated wealthtech and business productivity software.

“…the central advisor dashboard is increasingly shifting from the RIA custodian to the advisor’s CRM system…”

—Michael Kitces, July 5, 2021 blog post on kitces.com

While CRM is the central gateway to manage client relationships, it’s also at the intersection of integrated wealthtech. Today these integrations start at basic single-sign-on utility and one-way connections yet they’re advancing to two-way data flows and enhanced functionality in merging data between applications. The point here is that this progression of ever-improving API integrations and user experiences for a wide variety of software categories among products in the fragmented wealthtech space is occurring at the center of the software universe for advisors: CRM. Let’s look at the reasons why…

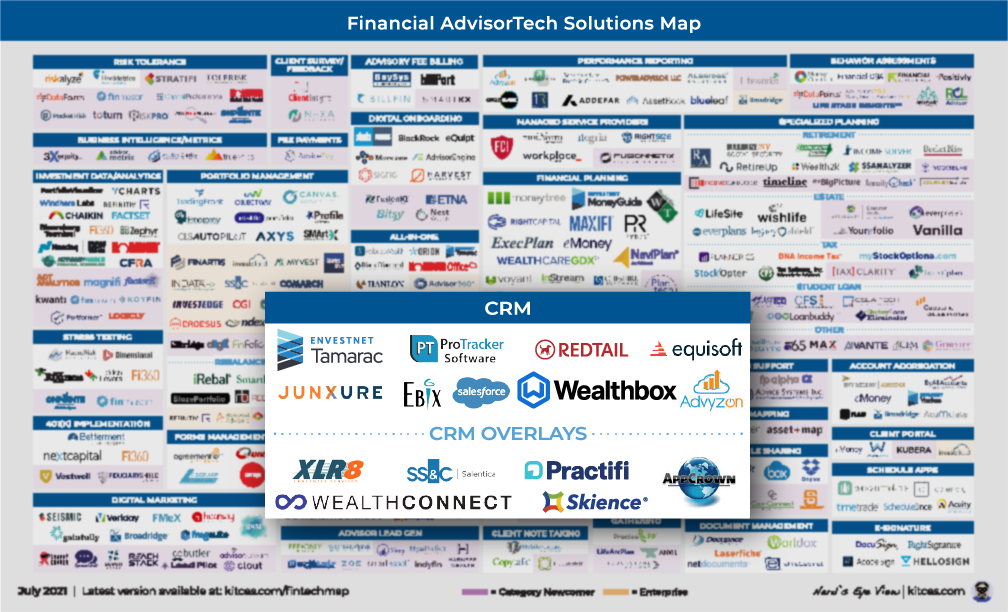

297 wealthtech apps and counting! Source: Kitces.com

7 Reasons Why CRM is Emerging as the Super App of Wealthtech

1 CRM is already #1

The trajectory to becoming the super app of wealthtech is supported by the fact that CRM is already the most popular software used by financial advisors. CRM has a big head start. Core features such as contact management, note recording, email, tasks, calendaring, workflows, opportunities, projects, reporting, and activity updates are all elegantly fused to manage client relationships and collaborate as a team to get work done – all in one place.

2 CRM is the Gateway

From user behavior, onboarding, and adoption points of view, CRM software is used by an advisor on Day 1 of entering the profession – way before using any other wealthtech software. (And the new advisor might have already used CRM technology in a previous job.) Clients first start out as family, friends, acquaintances, connections, or database leads in the contact management features of the CRM which turn via the functionality of CRM into prospects and then clients. All of these persona states are captured in a CRM, from the initial contact name being entered, to a task created, to sending an email, to a scheduling a calendar event for a meeting, to opening up an account for the new client. Assuming excellence in the product design, CRM usage is habit forming and it’s little wonder why our advisor customers regularly tell us it’s the first and last app they check into and out of at the start and end of a day.

3 CRM is a Workspace with Social Collaboration

CRMs with modern product design offer amazing communication and collaboration features to work effectively as a team in a workspace. In Wealthbox, for instance, we pioneered the social networking-style activity stream for coworkers and the home office to monitor CRM updates and interact with comments to posts and even add the flourishes of emojis. We layered in “social CRM” with activity streams, @-mentions, commenting, and notifications resulting in advisors checking in to see CRM work activity in the same way they check in to see activity of friends on social networks. This “sticky” user behavior amid a consumerized, humanized, and even “fun” user experience bodes well for a modern CRM’s trajectory as the dominant “go to” super app of wealthtech.

4 CRM is the Tech Hub

Uniquely, unlike other technologies for advisors, CRM as the technology hub integrates with virtually all 297 wealthtech apps such as financial planning, portfolio management, risk analysis, digital marketing, document storage, form tools, communication systems, custodial systems, and other business productivity software. This dominance of CRM at the center for advisors bodes well for its emergence as the super app of wealthtech, particularly as integration functionality advances and new, innovative add-on products in the core CRM come to market.

Moreover, we believe future innovation coming from big data, artificial intelligence, and machine-learning will be in CRM and at the junction of CRM and complementary wealthtech products. CRM products are elemental in business, and a “vertical CRM” designed specifically for wealth management with a broad range of integrations – which form a moat against other horizontally-positioned CRM competitors outside this space – is rocket fuel for becoming a super app.

5 CRM is a Flywheel

Along its growth trajectory the CRM super app is propelled by flywheels. In the business model of software-as-a-service, flywheel models of different sorts are used to efficiently attract, engage, and delight customers – which in turn brings on new customers. CRM is becoming a super app due it part to the flywheel effects created from the interplay with the apps that get connected to it.

In essence, integrating CRM with a wealthtech partner’s product increases the value of the CRM product (and the partner’s) while also getting distribution to the integration partner’s customer base, along with the joint promotion in the process. More customers beget more revenue which begets more new features and integrations which beget more customers and the wheel keeps spinning. And it spins even faster with multiple wealthtech vendors integrating into the CRM super app. Success creates success.

6 CRM is the Silver Bullet

For the most part, wealthtech apps only need to talk to the CRM. In this regard, CRM is the silver bullet ![]() that solves the problem of multiple software applications in use by an advisor that need to talk to each other. As the hub, CRM “plays nice” with all wealthtech vendors and custodial enterprise offerings to improve cross-product functionality. Indeed, CRM systems with their APIs can be multi-custodial, where advisors can open accounts and fetch client information, investment holdings, and held-away asset information from different, integrated custodians. As a core software and neutral hub, it’s little wonder why, in the move to independence, breakaway RIA teams migrate to a new CRM as their first app for their technology stack build-out in setting up shop.

that solves the problem of multiple software applications in use by an advisor that need to talk to each other. As the hub, CRM “plays nice” with all wealthtech vendors and custodial enterprise offerings to improve cross-product functionality. Indeed, CRM systems with their APIs can be multi-custodial, where advisors can open accounts and fetch client information, investment holdings, and held-away asset information from different, integrated custodians. As a core software and neutral hub, it’s little wonder why, in the move to independence, breakaway RIA teams migrate to a new CRM as their first app for their technology stack build-out in setting up shop.

7 CRM is Moving to the Center of the Universe

Notwithstanding the neutral position of a CRM super app described above in the ecosystem of wealthtech SaaS vendors, there are some gravitational shifts occurring in the cosmos. As some CRMs evolve into super app stardom, the gravitational pull from being at the center of the wealthtech universe creates a new world order. While not quite as disruptive as the Copernican Revolution, everyone senses a change in the wealthtech heavens. Indeed, as industry maven Michael Kitces recently pointed out, “…the central advisor dashboard is increasingly shifting from the RIA custodian to the advisor’s CRM system. Precisely because modern CRM systems can connect to outside providers via API to function as that central dashboard.” InvestmentNews also wrote about Aite Group’s report on this trend with the headline, Custodians No Longer at the Center of RIA Technology Hubs.

It’s a product. It’s a platform. …It’s a Super App!

So is a “super app” a product? A point solution? A tool? A platform? An ecosystem?

Yes!

Well, sorta… Words are challenging when describing software, due to its plasticity in accommodating different and changing business models.

True end-to-end, monolithic “platforms” in wealth management are difficult to build and sell. To date, they really don’t exist. The wealthtech space for RIAs, like most other SaaS software markets, carries on with product fragmentation. The behavior of “technology populism” amid the consumerization of information technology spawned at the dawn of Web 2.0 applications continues and gives advisors a voice and choice in the purchasing decisions on a range of wealthtech software categories. Product fragmentation isn’t going away anytime soon, particularly among choosy – and independent! – financial advisors.

While some bemoan the abundance of app choices and cry out for a single vendor platform to “do it all,” any end-to-end monolithic platform that theoretically “does everything” will always be punctured by innovative point solution products that attack its weaker features. New point solutions from free market competition represent innovation, to the benefit of advisors. A single, monolithic “does everything” platform, if it ever came to be, would ossify like a centrally planned economy and get pierced by innovative point solutions perpetually generated in the free market.

Compared to the ascendance of the CRM super app, which is at the foundation in a decentralized ecosystem of best-of-breed apps that gives choice to the advisor, it’s difficult for a single vendor’s monolithic platform to advance and scale in this space. Platforms need long selling cycles for management buy-in and then customizations, special configurations, instructional training, and technical integrations that require third-party consultants, administrators, developers, trainers, etc. In our wealthtech segment we call this the “CRM Industrial Complex.” Large implementations are expensive and time-consuming and often result in low adoption by end users; sometimes what’s left is a graveyard of human ambition.

Most advisors purchase software to solve a specific and pressing problem – such as managing client relationships, creating a financial plan, managing portfolios, performing risk analysis, etc. When being sold on a broad platform, an advisory firm has to imagine what the single platform can do for their practice. But the point solution presents a more concrete and immediate reality of what can be done to solve their needs, rather than what could be. And independent advisors – technology populists nonpareil – are signing up to various apps on their own.

In the longer view, as distinct from a single monolithic platform in wealthtech, CRM as an ever-improving product will be a gateway to a broader set of new features, better integrations, and new add-on products (some of which can replace certain integrations) and evolve into a super app, with ala carte and prix fixe options for the buyer. We think that’s where the market is headed, and a few apps, with CRM and custodial provisioning at their core, will be the next operating systems for advisors in the years to come, so much so that it won’t even be called “CRM” at that point.

It’ll be a super app in wealthtech for financial advisors.

We’ll see you there. ![]()