Results from the T3 2018 Advisor Survey

The survey results are in!

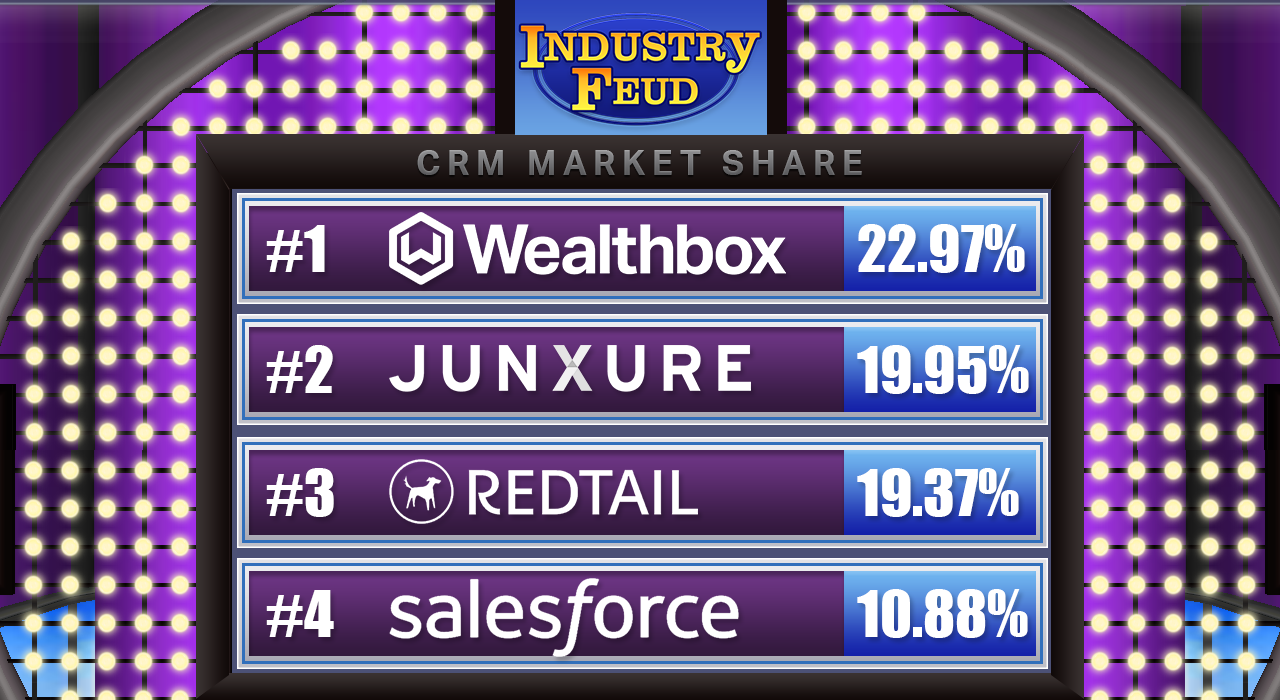

Wealthbox’s CRM market share has been ranked #1 in the annual survey conducted by Joel Bruckenstein of Technology Tools for Today (T3) and Bob Veres of Inside Information.

We’re honored! …Well, not really. We’re actually a bit burdened.

…Why? Because the T3 Advisor Survey, as it’s commonly known, at least with respect to the CRM category, is a collision of flawed research methodology and product passion. And now we need to take the time to explain it all, but hey, we’ll do so with alacrity! ![]()

Flawed Research

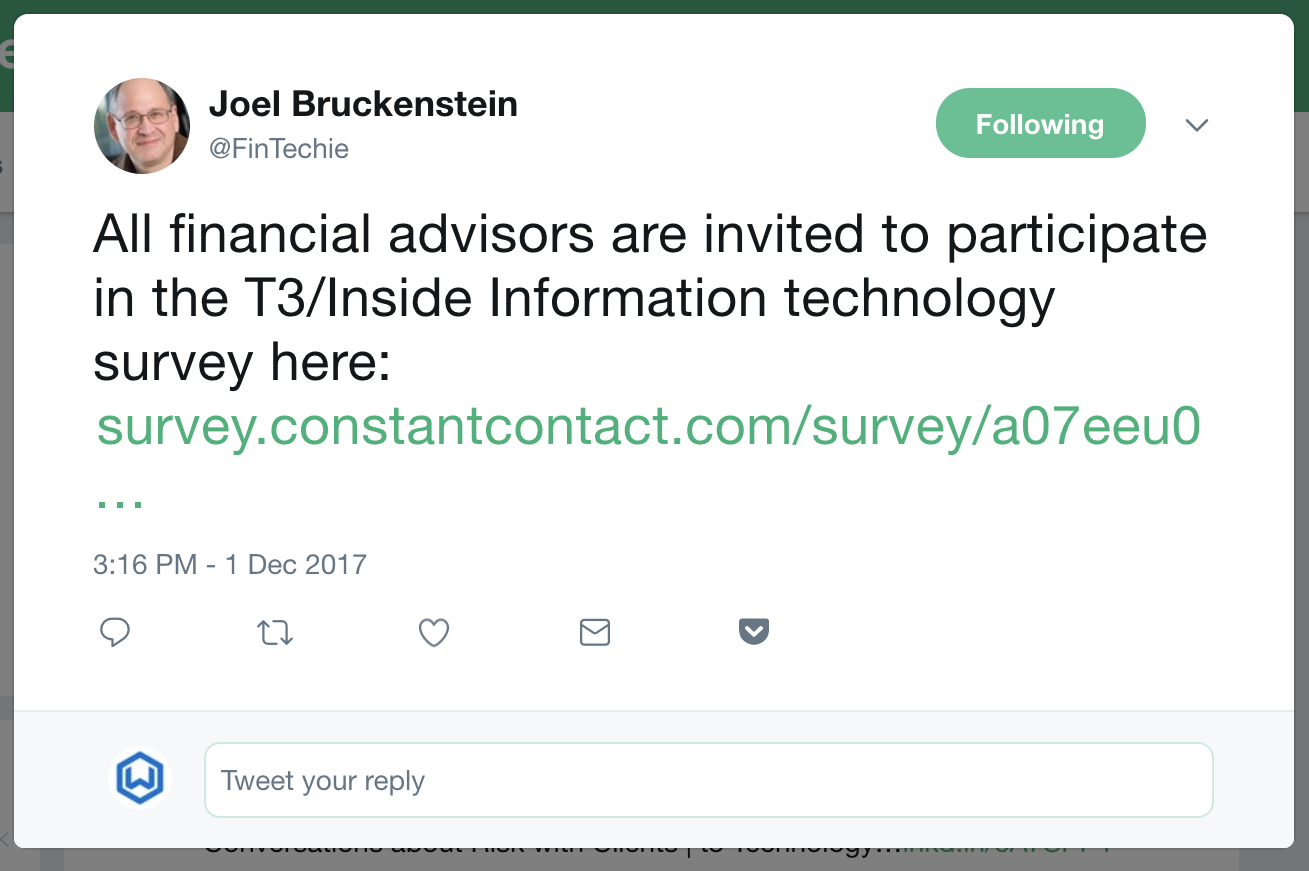

“Share the link!” …Tell your customers to vote!” …”Make your voice heard! …All advisors invited!”

The founders of Wealthbox have built 3 different CRM products over the last decade, and we’ve reluctantly participated in these online “research” surveys. For us, it’s damned if you do (because if you win the vote against incumbents, it looks odd) and damned if you don’t (in not showing up meaningfully in the results).

So, just like our CRM competitors who shared the link to the T3 Advisor Survey (and have for years in these type annual surveys), we also shared the link.

AdvisorEngine (owner of Junxure CRM) asking people to vote, like many other tech vendors did.

We don’t like these online surveys for market research purposes. They can be performed with incompetence, bias, or corruption.

In a snapshot temporal view, online survey results can also reinforce the perception of market dominance by some incumbent products (built upon legacy technology, some of which are even dying) while not conveying the whole story of an upstart’s product and progress against those incumbents. (Even the methodology of the T3 Advisor survey changes over the years, adding to unreliability when viewed over time.)

For instance, if an advisor sees a vendor with a double digit market share percent and compares that to a startup vendor with a low single digit percent number, he or she might be inclined to think the product with the larger market share is the better product. But in the software space, that’s not necessarily true.

Indeed, sometimes it works like the reverse of an aging fine wine: the older the technology vintage, the worse the product. And today, many advisors are effectively “stuck” in some CRM products because of long-term contracts, broker-dealer mandates or platform limitations, or by being locked-in by outdated technology platforms from “market leaders,” unable to easily migrate to modern CRM software products.

Trade publishers like Messrs. Bruckenstein and Veres, no doubt with good intentions, use these online surveys because they’re a cheap and easy albeit unscientific way to get a sense of advisor tech usage while promoting their brands and establishing a sense of authority in the market. Surveys also generate site traffic for them to promote their services or sell sponsorships.

But the bottom line is these simplistic online surveys can be inaccurate. SHOCKER!!!

Product Passion Rocks the Vote (and the Boat)

“The most head-scratching responses came from what we can only assume to be avid Wealthbox users…” — T3 2018 Advisor Survey report

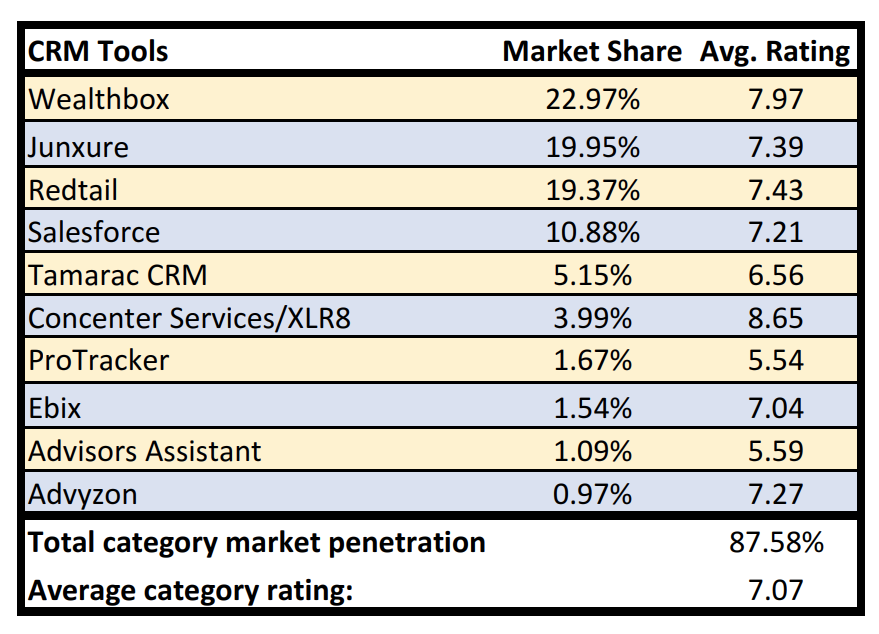

That Wealthbox ranked as #1 in popularity doesn’t jibe against a market share reality in 2018. (See image of T3 Advisor Survey, at right.) After all, we’ve only been in business for 4 years!

Compare that to…

Salesforce, after 18 years in business is the popular Wall Street darling of CRM.

Redtail, after 15 years in business, claims its raving fans are from a base of “over 100,000 users” for its CRM product.

Junxure, after 17 years in business, reports its “12,000 users” give its CRM a “98 percent satisfaction rate” and touts it’s the “Most Awarded CRM” that wins again and again.

So with the brand popularity, the 100,000 fans, and those repeating awards, why were these CRM vendors behind Wealthbox in the T3 Advisor Survey? ![]()

Fun fact: This isn’t the first time Wealthbox users rocked the boat with online polling. In 2015 a well-known industry publication had to withhold their online survey results for CRM. Why? …Because Wealthbox came in #1 and won by a landslide with a 40% market share. In a mutually friendly and amused conversation we had with an executive at the publication, we totally understood why they didn’t publish the inaccurate finding; they certainly now appreciate the power of brand advocates and the difficulty of online surveying.

Maybe what these online surveys are best for is getting a sense of product passion. It’s one thing to ask advisors to take a survey; it’s quite another for advisors to spend 5 minutes and actually do that. We can’t control our users’ decisions in taking surveys. So if industry publishers doing “research” are going to ask advisors to take a vote, Wealthbox users just might rock that vote.

Be mindful of product passion. Love conquers all! ![]()

A footnote

Notwithstanding that Wealthbox launched at a T3 event and supported ensuing T3 conferences, until this survey it’s factually evident that Joel Bruckenstein has had difficulty at industry events in recognizing Wealthbox’s existence as a CRM vendor. The reason? We have no idea.

In February of 2016 at a large broker-dealer conference where we were a sponsoring exhibitor, Joel omitted Wealthbox in a list of CRM vendors in his presentation to hundreds advisors. Perplexed, we wrote him with a friendly note, asking why. He emailed back, “Glad you mentioned it. I’ll try to update the slide for future events.”

Unfortunately, the “try to update the slide” didn’t happen. At yet another industry conference, where Wealthbox was both a sponsor and had panelist speaker representation onstage, Joel gave a slide presentation to 600 advisors, and once again didn’t list Wealthbox as a CRM option in the market. Disrespectful to us, but also a disservice to the financial advisors in the audience to not be made aware of a CRM option, so we called him out on it. His retort contradicted his own research, and his odd insult of our assigned tabletop during an exhibit break didn’t help matters. Even recently, Joel still publicly disses Wealthbox and the tech-savvy advisors who choose to use it in their tech stack. In the end, the customer voices for T3’s own research were too strong; it was nice to see Wealthbox get listed at the recent T3 conference!

Which brings us to the language used in the T3 2018 Advisor Survey report, released at the recent T3 conference. The authors (or perhaps Joel, singularly) write with veiled swipes and negative connotations of Wealthbox in both the introduction and CRM sections of the report. In an age of increasing transparency, the bias is refreshingly transparent!

The T3 Advisor Survey notes “…a high number of XY Planning Network members participated in the survey—and we sincerely thank Michael Kitces and Alan Moore for promoting the survey to this constituency. But, as you’ll see in the CRM section of this report, that created some interesting market share numbers in the CRM rankings.”

Our response: The XY Planning Network, while a fast-growing and valued customer using our advisor network offering, is not our largest customer and is actually just a small part of Wealthbox’s total user base. (Also, attributing voter results to XYPN doesn’t explain how we won 40% of the CRM market share vote in 2015 in the other aforementioned survey, when XYPN was just getting started.) And in the T3 Advisor Survey, why didn’t customers of competing CRM vendors who promoted the survey show up to vote with those huge customer bases?

The T3 Advisor Survey takes pains to belittle Wealthbox and by extension our advisor customers, even though its own “research” shows Wealthbox competing handily with Redtail based on size of firm, business model, and years in business. Wealthbox’s “less than 6%” and “miniscule” results with “larger” firms really means the very “largest firms” category above $4M in revenues, where Redtail doesn’t do much better at 9.25%. Cherry-picked analysis, misleading words, distortion. Fake news within fake research.

This doozy of a passage in the T3 Advisor Survey gave us a good chuckle:

“The larger the firm, and the more experienced the advisor, the more popular Junxure is likely to be.” …followed by… “the less experienced the advisor, the more likely he or she was to use Wealthbox.”

Seriously?

This is a “tech” survey, right? If the authors choose to insert that gratuitous, implied insult against our product and customers, we ask: “experienced” with what? …Experienced with financial planning? Or experienced with technology to empower financial planning? Are the 10,000 advisors that use Junxure’s old desktop CRM software indicative of where the CRM market is going?

We’d suggest to Messrs. Bruckenstein and Veres that Wealthbox users – that include many 10 – 40 person RIA firms, nationwide advisor networks (beyond XYPN) with billions under management, and rising stars of fast-growing, prominent advisory firms noted for their tech-forward operations who have defected from the leading CRM incumbents – are a legitimate representation of where CRM technology is and is going. These experienced, tech-savvy advisors are certainly distinct from the vague “more experienced advisors” imagined in the T3 survey report, a significant number of whom are handcuffed to legacy technologies from a variety of vendors. We hear day after day after day about the problems these experienced advisors experience trying to escape and migrate away from what’s been sold to them.

For the record, the reader should be aware that we don’t know and have never met Bob Veres. We only hear and see great things about his work related to financial planning and portfolio management practices. Subscribe to his well-regarded newsletter here.

With respect to Joel, we remain baffled at this negative bias which can hurt our business and is detrimental to the advisor community. He’s done a great job of rounding up tech vendors for Technology Tools for Today conferences and getting this group deserved visibility and fostering partnerships. (Even co-author Bob awards Joel!) And Joel’s reveling as “the Godfather of Fintech” at the recent T3 conference is hilarious on two counts. First, the photoshopped image of Joel as Vito Corleone from The Godfather movie speaks to the good cheer amid social friendships and economic relationships forged over many years at T3. Second, it’s hilarious at how tone-deaf it is in the suggestive vibe of mafia cronies, as if doing back-room tech deals and overlording a racket.

Indeed, in an industry that clamors for fiduciary-rule openness for investors and conflict-of-interest disclosure, transparency, honesty, and fairness, it’s quite ironic and a bit peculiar for an industry consultant to promote being perceived as a back-room dealing mob boss. But hey, it’s funny!

Continue the comedy and cruise on over to T3’s anachronistically named “Virtual Exhibit Hall,” a new destination on the information superhighway where “every technology provider has been verified with the T3 Standard of Excellence.”

Just don’t ask what that “standard” is. Fuhgeddaboudit. Capisce?