2025: A Milestone Year for Wealthbox

As 2025 comes to a close, Wealthbox is proud to look back on a year defined by product innovation, platform expansion, and accelerating momentum among advisory firms choosing simpler, smarter CRM technology. Throughout the year, our focus remained consistent: deliver an elegant, intuitive experience that enables financial advisors to work efficiently, collaborate seamlessly, and serve clients with confidence. With advancements in AI, reporting, compliance functionality, and enterprise capabilities, 2025 marked one of the most significant periods of growth in our history.

To highlight the key moments, improvements, and product releases that shaped this year, we’ve outlined the major updates in the sections below.

New Features Released

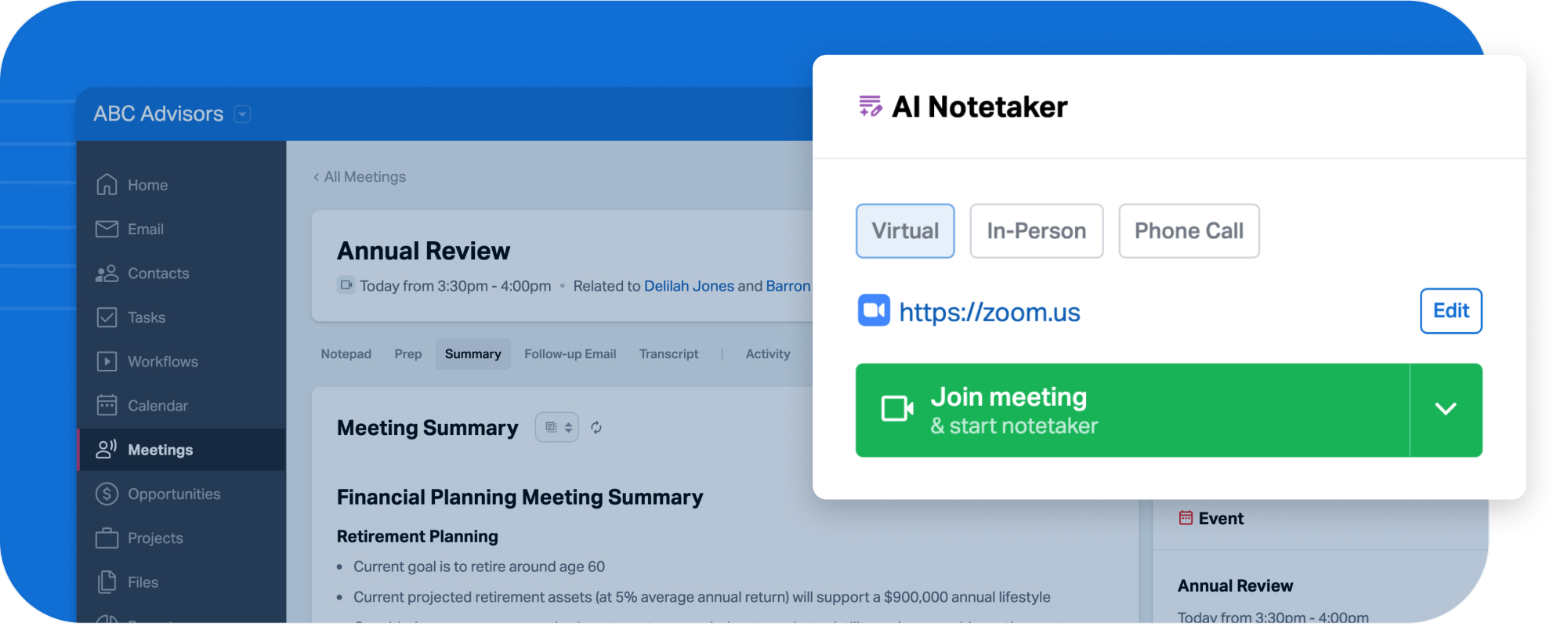

The AI Notetaker

The biggest milestone of 2025 was the debut of the Wealthbox AI Notetaker, the first advisor-focused meeting assistant natively embedded within an industry-leading CRM. From the moment it launched, the AI Notetaker reshaped how teams prepare for and follow up on meetings. Advisors can rely on clear, consistent summaries that highlight key discussion points, action items, and next steps, ensuring nothing falls through the cracks. Tasks and follow-ups are organized directly within Wealthbox, helping teams maintain momentum without juggling external tools or manual notes.

Early adopters quickly embraced the tool for its accuracy, ease of use, and seamless integration into existing workflows. For busy advisory firms, the impact was immediate: better documentation, improved collaboration, and more time freed up to focus on client relationships rather than paperwork.

While adoption continues to grow, the AI Notetaker is already redefining standards for meeting documentation in Wealthtech. It represents a major step forward in how advisors capture and use client insights, and sets the foundation for even more meaningful AI-driven capabilities across the Wealthbox platform in the years ahead.

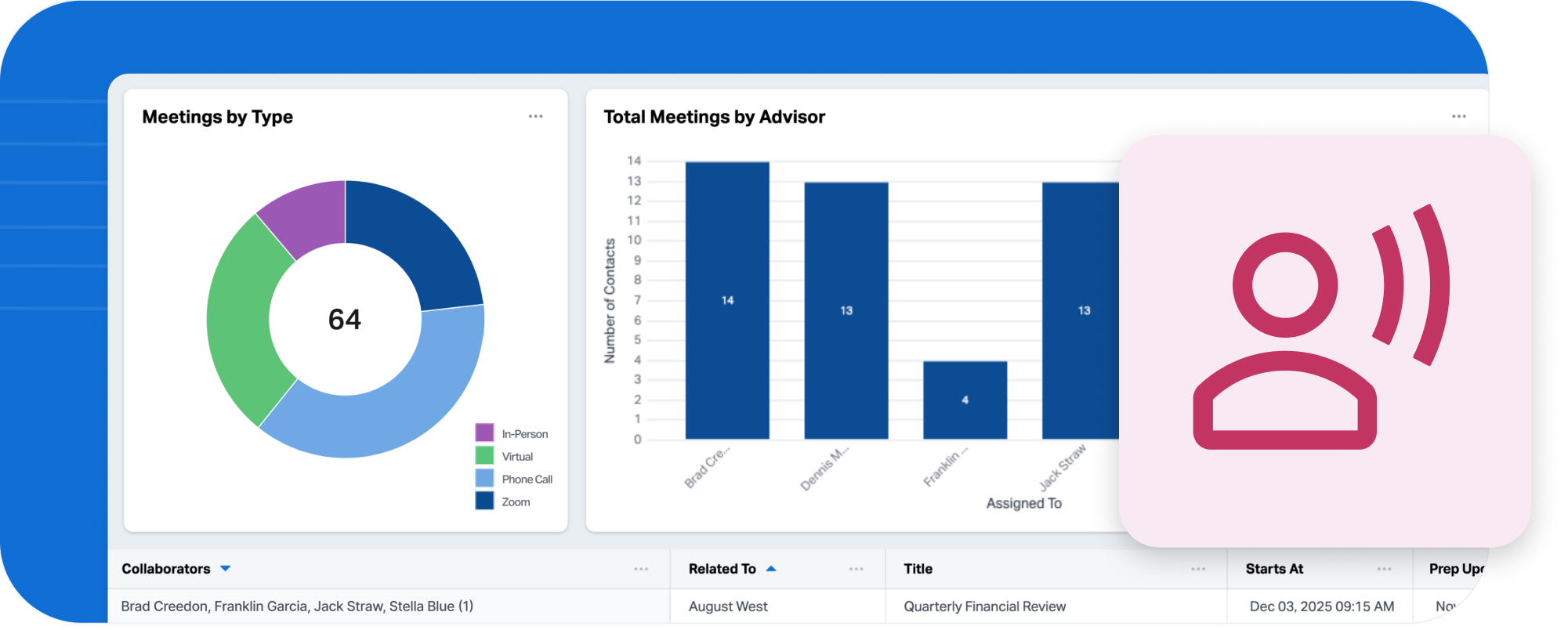

Meeting Reports

Another major advancement this year was the introduction of Meeting Reports, a new reporting category that gives advisory teams deeper visibility into their client interactions. Built on the foundation of the new Meetings feature and supported by the structure the AI Notetaker brings to conversations, Meeting Reports allow firms to review and analyze meetings with the same flexibility they have with tasks, workflows, and other core CRM data.

With the new Meetings report object, advisors can build customized reports that focus specifically on client meetings. Teams can filter and group their data, surface trends, track activity levels, and highlight the details that matter most to their practice. This expanded reporting capability helps advisors see patterns in their interactions, ensure consistent follow-up, and maintain a clear and organized view of every client touchpoint.

Omniview Reporting

Omniview Reporting gives firms the oversight and transparency they need to operate efficiently at scale. Available on Premier and Enterprise plans, Omniview allows authorized users to generate reports that provide a complete, organization-wide view of CRM data while staying fully within Wealthbox.

Visibility settings play an important role in day-to-day operations by controlling access to client information. However, supervisors, compliance officers, and operations teams often need a broader perspective that goes beyond individual permissions. Omniview delivers that level of clarity by allowing approved users to run reports that include all records in the workspace, regardless of ownership or visibility rules. This expanded insight helps firm leaders monitor activity, meet compliance expectations, and understand performance across the entire organization, all without relying on manual exports or switching between accounts.

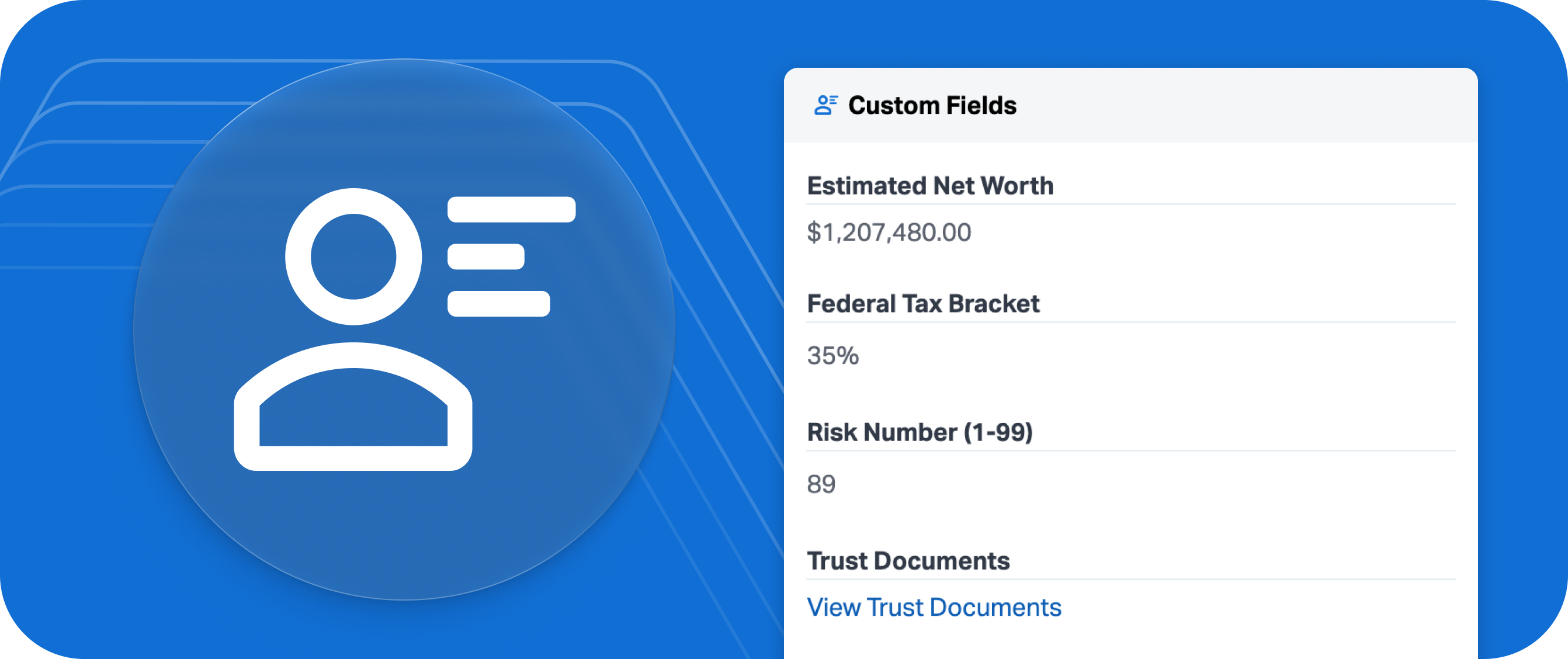

Custom Field Types for Currency, Number, Percentage, and Hyperlinks

Wealthbox expanded its customization capabilities with the introduction of new custom field types that give advisors greater control over how they capture and organize client information. The platform now supports Currency, Number, Percentage, and Hyperlink fields, along with the option to set default values in single-select dropdowns.

These additions allow users to store structured financial and planning data in a way that is optimized for reporting, filtering, and deeper insight generation. Whether firms are tracking net worth, monitoring key metrics, or linking to external documents, the updated field options provide more ways to adapt Wealthbox to the specific workflows and data requirements of each practice.

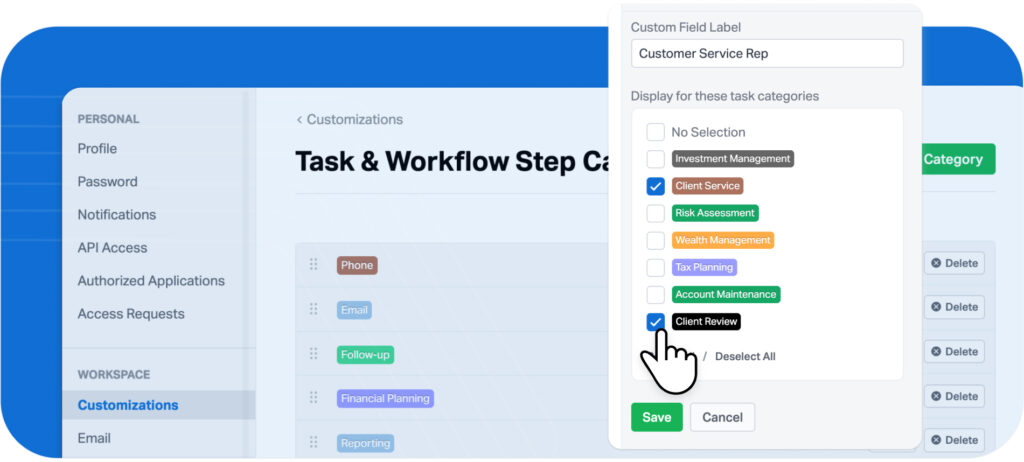

Category-Based Custom Fields

Wealthbox introduced Category-Based Custom Fields this year, a new capability that gives advisors more control over how tasks are organized and displayed. Available on the Premier and Enterprise plans, this enhancement allows firms to surface the right information at the right moment, creating a more efficient and focused task management experience.

With Category-Based Custom Fields, users can determine which custom fields appear based on the task category they select. This provides a tailored approach to task creation by showing only the most relevant details for each task type, reducing clutter and improving clarity. For example, a “Follow-Up” task can display a field specific to that task category, helping teams capture the exact information they need while keeping task lists clean and organized.

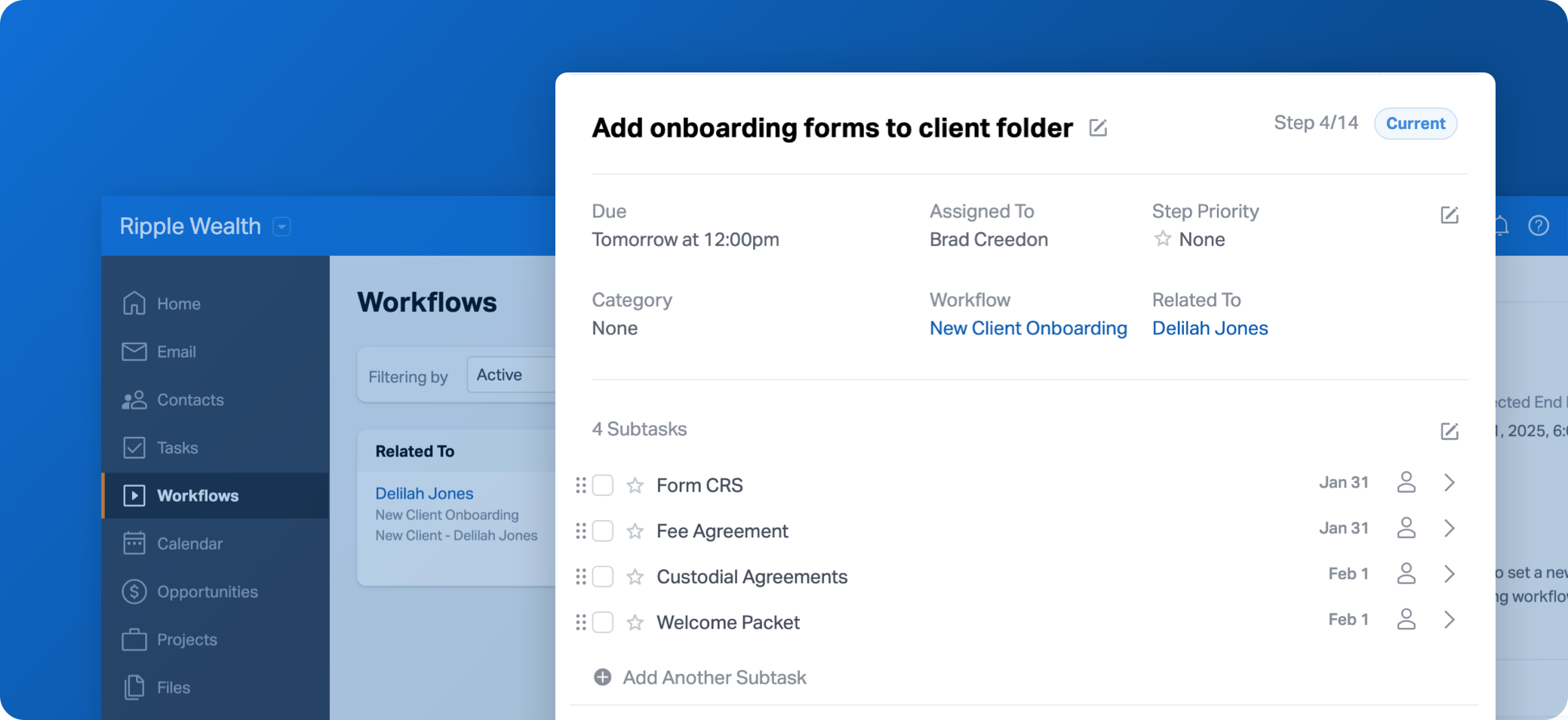

Subtasks for Workflows

Wealthbox enhanced workflow templates with the addition of Subtasks, giving advisors a practical way to break down complex processes into smaller, actionable steps. This feature adds flexibility to sequential workflows, helping teams stay organized, track progress, and ensure that no task is overlooked. By incorporating subtasks, advisors can streamline workflows and improve productivity across their practices.

Subtasks enable users to divide larger workflow steps into more manageable pieces. With this enhancement, Wealthbox allows multiple users to work on different parts of a step in parallel, even within sequential workflows. This capability makes it easier to tackle complex processes efficiently and maintain a clear view of progress from start to finish, supporting better collaboration and organization across teams.

Inline Editing and Improved Task/Workflow Design

Wealthbox delivered major updates to tasks and workflow steps, making it easier than ever for advisors to manage their daily work. Designed with Wealthbox’s focus on simplicity, power, and clarity, these enhancements allow users to navigate, edit, and complete tasks more efficiently. The updates streamline workflows, reduce friction, and create a seamless experience that helps advisors stay organized and focused on serving clients.

New Integrations Released

Over the past year, Wealthbox expanded its ecosystem with 19 new partner integrations, designed to streamline operations further and enhance client services. These integrations enable advisors to seamlessly connect Wealthbox with other essential tools and platforms, improving efficiency and delivering a more integrated client experience. These represent just a portion of the integrations launched this year. For a full listing of all our integration partners, click here.

LPL Financial

The enhanced integration with LPL ClientWorks introduced a powerful two-way sync between Wealthbox and LPL, ensuring that client data is accurate, up-to-date, and accessible across both platforms. This update streamlines advisor workflows by automatically syncing account details, contacts, and household information in real time, eliminating manual data entry and reducing the risk of errors. Advisors can now seamlessly manage client relationships, track updates, and stay organized without switching between systems, making this one of the most impactful integrations for firms using Wealthbox and LPL ClientWorks.

Other integrations this year include:

Estately

The integration with Estately allows advisors to access client information, including names, email addresses, dates of birth, and home addresses, from Wealthbox directly within the Estately platform.

Fispoke

With the Fispoke integration, advisors can pre-fill client deposit and lending applications directly from Wealthbox, streamlining account setup and reducing manual entry errors.

Invent

The integration with Invent allows advisors to sync client, prospect, notes, and task data from Wealthbox with custodian feeds, financial planning goals, and performance reports, creating a unified and up-to-date view across systems.

Envestnet

Advisors can use the Envestnet integration to access account and position information, initiate investment proposals, and navigate between platforms using single sign-on—all directly within Wealthbox.

Yext

The integration with Yext Relate allows advisors to sync contacts and capture text and voice communication history directly within Wealthbox, creating a complete and compliant record of client interactions.

Corporate Merch

Advisors using Corporate Merch can easily send branded gifts directly from Wealthbox, streamlining the process and creating memorable client touchpoints with ease.

Strety

The integration with Strety allows advisors to link EOS-driven To-Dos with Wealthbox Tasks, creating a seamless connection between operational goals and day-to-day client management.

TradePMR

Using the TradePMR integration, advisors can connect their Fusion custodial platform with Wealthbox, streamlining account management and client workflows while enhancing productivity and the overall client experience.

Flextract

The integration with Flextract allows advisors to automatically import client demographic and financial data into Wealthbox, reducing manual entry and streamlining onboarding and reviews.

Turnqey

The Turnqey integration allows advisors to access client cryptoasset data and analytics directly within Wealthbox, providing greater visibility into this growing asset class.

RightCapital

With the enhanced RightCapital integration, advisors are able to view client notes and tasks from RightCapital directly within Wealthbox, providing real-time visibility into planning activity and improving workflow collaboration.

Mili

The integration with Mili allows advisors to sync real-time, recording-free meeting notes and action items directly into Wealthbox, improving client record-keeping and productivity.

Fireflies.ai

With the Fireflies integration, advisors can capture meeting transcripts, notes, and follow-up tasks directly within Wealthbox, streamlining CRM updates and improving client interactions.

LeadCenter.AI

The integration with LeadCenter allows advisors to sync contacts and prospects directly into Wealthbox, streamlining lead management and marketing workflows.

Focal

Advisors using the Focal integration can sync AI-generated meeting summaries, tasks, and client contact information directly into Wealthbox, enhancing efficiency and collaboration.

Educational Webinars Hosted in 2025

In 2025, Wealthbox hosted 96 webinars! We continue to provide the wealthtech community with a range of educational webinars about workflows, best practices, CE credit events, and tech partner integrations.

Here’s a quick overview of all the webinars we hosted in 2025 (click on the event to watch a recording):

Integration Demos

- How Advisors Use Focal + Wealthbox to Streamline Meeting Management

- How Advisors Use Thyme + Wealthbox for Smarter Client Meetings

- A Live Demo of the Two-Way Sync Between LPL ClientWorks + Wealthbox

- How Advisors Use LeadCenter + Wealthbox for Lead Management and Client Acquisition

- How Advisors Use Fireflies + Wealthbox to Simplify Meeting Management

- How Advisors Use Mili + Wealthbox for Seamless Meeting Follow-Ups

- How Advisors Use Flextract + Wealthbox to Simplify Data Gathering

- How Advisors Use TradePMR and Wealthbox for Streamlined Account Management

- How Advisors Use Corporate Merch + Wealthbox to Strengthen Client Relationships Through Gifting

- How Advisors Use Strety + Wealthbox to Run Their Firms on EOS

- How Advisors Use Envestnet + Wealthbox to Streamline Planning and Portfolio Management

- How Advisors Use Invent + Wealthbox to Simplify Workflows and Unify Data

- How Advisors Use Fispoke + Wealthbox to Streamline Private Banking for Clients

- How Advisors Use Estately + Wealthbox to Streamline Estate Planning

- Wealthbox AI Notetaker for Osaic Financial Professionals

Workflows

- Boost Practice Efficiency with Wealthbox Workflows

- Designing Workflows That Work for Your Team

- 5 Featured Workflows for Advisors in Wealthbox

- Streamline Proposal Creation with StratiFi + Wealthbox

- Delivering Impactful Annual Reviews with Asset-Map + Wealthbox

- VoIP Messaging + CRM for Advisors with Simplii + Wealthbox

- Year-End Planning Made Simple with fpPathfinder + Wealthbox

Continuing Education

- Enhancing Cyber Security in Advisor Workflows with YourCyber.Life + Wealthbox (CFP® CE)

- Uncovering The Five Factors of Investor Personality & Risk Tolerance (CFP® CE)

- Navigating the Crypto Frontier: Insights and Strategies for Financial Advisors (CFP® CE)

- How Advisors Can Leverage AI for Efficiency and Growth (CFP® CE)

- AI Cyber Threats with Wealthbox + YourCyber.Life (CFP® CE)

- One Big Beautiful Bill: A Comprehensive Overview of Tax Changes and Planning Opportunities (CFP® CE)

- Turning Interest Rate Concerns into Advisor Opportunities with Max + Wealthbox (CFP® CE)

Best Practices

- How to Attract High-Net-Worth Clients with Social Media

- Preparing for 2025: Enhancing Caller Experience and Client Engagement

- Streamline Client Meeting Preparation with Pulse360 + Wealthbox

- Elevating Customer Experience with Quik! and Wealthbox

- Streamline Your Practice with RightCapital + Wealthbox

- Automate Your Best Advice During Life Events with Bento Engine and Zeplyn

- Enhance Client Relationships with Asset-Map and Wealthbox

- Converting Website Clicks into Clients with FMG + Wealthbox

- Optimizing Client Relationships with Responsive AI + Wealthbox

- Building Personalized Investment Proposals with TIFIN Wealth + Wealthbox

- Best Practices for Accelerating Client Acquisition

- Optimizing CRM and Automation for Scalable Growth with Versoft + Wealthbox

- Scaling Your Firm with Estate Planning with Trust & Will + Wealthbox

- Accelerating Client Conversions with StratiFi + Wealthbox

- Enhance Firm Growth Using Revenue Analytics with Smart Kx + Wealthbox

- The “GOALS” for Growth: Best Practices to Grow, Protect, and Scale Your Advisory Firm

- Proactive Client Engagement with GReminders + Wealthbox

- How to Implement AI in Your Practice with Beemo Automation + Wealthbox

- Building Trust in a Digital World with Levitate + Wealthbox

- AI-Driven Content Creation for Advisor Marketing with Altruist + Wealthbox

- Mastering Financial Planning with MoneyGuide + Wealthbox

- Enhancing Advisor Efficiency with Docupace + Wealthbox

- Hot Features in Wealthbox that Fire Up an Advisor’s Day

- Best Practices for Streamlining Your Tech Stack and Improving Productivity with RightCapital + Wealthbox

- How Silvertree Wealth Partners Uses Wealthbox to Drive Growth

- Delivering Timely Advice with Bento Engine + Wealthbox

- Driving Multigenerational Retention Through Estate Planning Strategies with FP Alpha + Wealthbox

- Using Dashboards in Wealthbox to Make Better Business Decisions

- Using Wealthbox to Deliver an Exceptional Client Experience

- Practical Advisor AI: Current Tools and Future Trends with Jump + Wealthbox

- Expediting Client Prospecting and Onboarding with Smartdata + Wealthbox

- College Reimbursement Strategies with BackNine + Wealthbox

- Turning Leads into Growth with SmartAsset and Wealthbox

- Eliminate the Hidden Costs of Messy Data with Milemarker + Wealthbox

- Scale Without the Stress with Level Best + Wealthbox

- Deliver Personalized Advisor Experiences with AdvicePay + Wealthbox

- How RIAs Can Lead in the Age of Behavioral Finance with Wealthbox + Andes Risk

- How to Drive Intelligent Client Engagement with Fynancial + Wealthbox

- Perfecting the Prospecting Process with Wealthbox + VRGL

- Best Practices for Enterprise Firms in Streamlining Their Tech Stack and Improving Productivity

- Mergers, Valuation & Succession Planning with Wealthbox + Fin.Link

- Growth Strategies for Every Stage of Your Firm with Nitrogen + Wealthbox

- Maximizing Team Efficiency in Advisory Firms with Wealthbox and Sphynx Automation

- Using CRM Tags to Power Personalized Client Communication with Blueleaf + Wealthbox

- Streamline Compliance and Grow Your RIA with Wealthbox and Comply

- Using AI and Social Proof to Boost Advisor Visibility Online with Testimonial iQ + Wealthbox

- Streamline Your Tax Letters with Wealthbox and Holistiplan

- How to Use AI to Create Hyper-Personalized Content with Wealthbox and FMG

- 5 Time-Saving Automations for Advisors with Wealthbox + Advisor Tech Partners

- Automating Advisor Workflows at Scale with Beemo Automation + Wealthbox

- The New Client Experience: Proactive, Personalized, Predictive with VRGL, WealthFeed, and Wealthbox

- Simplify Your CRM with Simplicity Ops + Wealthbox

- AI-Powered Personalization with PreciseFP + Wealthbox

- The Human-Centric Tech Stack with DataPoints + Wealthbox

- Intelligent Timing Meets Intentional Action with Bento Engine + Wealthbox

- Strengthening Financial Relationships with Bone Fide Wealth + Wealthbox

- Proactive Estate Planning with Trust & Will + Wealthbox

- Customized Dashboards, Omniview Reporting, and AI Notetaking: 3 Features in Wealthbox for Large Firms

- Client Experience by Design with GReminders + Wealthbox

- Launch and Scale Your Independent Advisory Practice with Altruist + Wealthbox

- Bringing Discipline and Documentation to Advisory Operations with StratiFi + Wealthbox

Product Updates

- What’s New in Wealthbox?

- Streamline Your Workflows with Subtasks in Wealthbox

- Turn CRM Data into Insightful Reports with Wealthbox

- Why Advisors Choose the Wealthbox Premier Plan

- Introducing the Wealthbox AI Notetaker

- New Productivity Features in Wealthbox: The CRM + AI Workspace

Company Updates

Wealthbox Secures $200M Investment from Sixth Street Growth

Wealthbox secured a $200 million majority investment from Sixth Street Growth, the growth-investing business of the leading global investment firm Sixth Street. The partnership marks a major milestone in Wealthbox’s evolution and positions the company to scale its operations further, accelerate product development, and expand its footprint across the wealth management industry.

Wealthbox Named #1 CRM in the 2025 Kitces Report

This year’s Kitces Report of the Technology That Financial Advisors Actually Use and Like delivered a milestone moment for Wealthbox. The study, regarded as one of the industry’s most trusted benchmarks for advisor technology adoption, named Wealthbox the #1 CRM in market share, surpassing long-established competitors and reflecting a major shift in the CRM landscape.

The findings highlight the growing role of CRM as the central hub of advisory firm operations, with nearly half of firms now relying on their CRM as the core system powering workflows, collaboration, and scale. Wealthbox’s rise to the top spot underscores this evolution. The report notes Wealthbox’s significant momentum in moving upmarket, expanding beyond solo and small firms to increased adoption among midsize and large practices, reinforcing the platform’s ability to meet the operational and complexity needs of larger organizations.

This recognition reflects the steady growth, product innovation, and advisor satisfaction that defined Wealthbox’s past year, and sets a strong foundation for continued expansion across the advisory community.

Looking Ahead to 2026

As 2025 comes to a close, Wealthbox is energized by the support and enthusiasm advisors have shown throughout a year of meaningful product progress. The momentum doesn’t stop here. In 2026, the team will continue pushing forward with new features and thoughtful enhancements shaped by the advisors who use Wealthbox every day. Thank you for being part of the Wealthbox community — the best is still ahead.